On January 1,2012,Orbit,Inc.purchased land and a building for a total of $90,000 by paying $20,000 cash and issuing a note for the rest.The market value of the building was appraised at $80,000 and the land at $20,000.Write in both the correct dollar amounts and the account titles involved.Use a plus for increases and parentheses ()for decreases.

Part A: Show the effect of the purchase on the accounting equation.

Part B: Show the effect of the first year's depreciation,assuming the straight-line method and an estimated useful life of 20 years with a $32,000 salvage value.

Part B: Show the effect of the first year's depreciation,assuming the straight-line method and an estimated useful life of 20 years with a $32,000 salvage value.

Part C: Show the effect of the first year's depreciation,assuming double-declining depreciation and an estimated useful life of 20 years with a $32,000 salvage value.

Part C: Show the effect of the first year's depreciation,assuming double-declining depreciation and an estimated useful life of 20 years with a $32,000 salvage value.

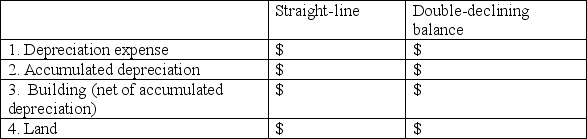

Part D: Show the amounts that would appear on the annual financial statements at the end of the THIRD YEAR for each method.

Part D: Show the amounts that would appear on the annual financial statements at the end of the THIRD YEAR for each method.

Definitions:

Arbitration Boards

Panels established to resolve disputes between parties through the arbitration process rather than through court litigation.

Binding Awards

Decisions made by an arbitrator or judicial body that are legally enforceable and must be adhered to by the parties involved.

Restraint Of Trade

Agreement between firms to fix prices, injure competition, or prevent others from entering a market.

Exclusive Bargaining Representative

A labor union that has the sole authority to negotiate the terms of employment on behalf of all employees in a specific workplace.

Q11: Inventory information for Missoula Merchandising,Inc.is provided below.Sales

Q69: According to GAAP,which of the following items

Q107: Goldilocks is the bookkeeper for Three Bears

Q132: A machine was purchased for $100,000 in

Q149: A machine was purchased for $100,000 in

Q187: Which statement below is TRUE regarding the

Q193: Tiny Toy Company makes toys and sells

Q249: Inventory information for Great Falls Merchandising,Inc.is provided

Q252: An employee's gross pay is recorded as

Q307: On July 1,2011,Ace Electronics issued $10 million