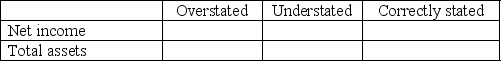

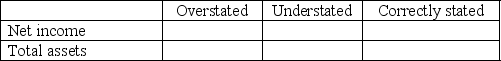

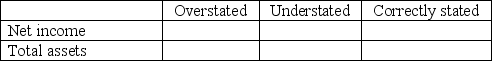

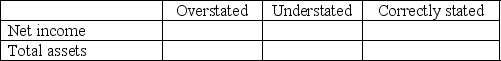

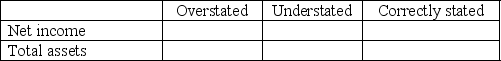

Robin Blind,Inc.recorded the following entries during the year.Put an X in the appropriate box to indicate whether each entry caused net income and total assets to be overstated,understated,or correctly stated.

1.Recorded depreciation for the year using $0 salvage value when the salvage value was expected to be $5,000.

2.Depreciated its airplanes over a life of 35 years,which is 10 years longer than the average life of airplanes.

2.Depreciated its airplanes over a life of 35 years,which is 10 years longer than the average life of airplanes.

3.Recorded ordinary repairs as capital expenditures.

3.Recorded ordinary repairs as capital expenditures.

4.Recorded the purchase of patents as an expense.The purchase should have been capitalized.

4.Recorded the purchase of patents as an expense.The purchase should have been capitalized.

5.Recorded its research and development costs as expenses.

5.Recorded its research and development costs as expenses.

Definitions:

Health Assessment

The comprehensive evaluation of a person’s physical, psychological, and social health status, performed by a healthcare professional.

Lindane-Based

Refers to products or medications containing Lindane, a chemical used to treat lice and scabies by affecting the nervous system of these parasites.

Fine-Toothed Comb

A comb with very close-set teeth used for detailed grooming or searching through something thoroughly.

Vinegar Hair Rinse

A hair treatment using diluted vinegar, typically apple cider vinegar, to clean the scalp, restore natural pH levels, and add shine to hair.

Q21: Part A: Put an X in the

Q39: Y Company obtained the following balances from

Q66: Cash is an asset that must be

Q132: The allowance method provides a good match

Q154: Which statement below best describes the meaning

Q155: A purchase order is a document that

Q162: Cash is found on the _.<br>A)Income statement<br>B)Balance

Q189: Sales returns and allowances is a contra-asset

Q209: On January 1,2011,Tiler Company purchased equipment that

Q258: The risk associated with debt is risk