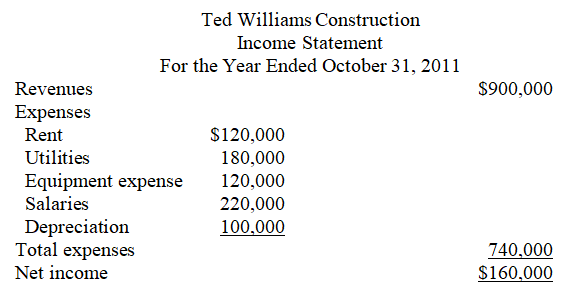

A client has asked you to review and correct the following income statement: Additional information:

Additional information:

a.A $3,500 machine tune-up was recorded as an asset.

b.The costs of buying a $120,000 piece of equipment on the last day of the fiscal year were treated as equipment expense.

c.An asset with a cost of $230,000,a 10-year useful life,and a zero salvage value was depreciated $23,000 for the full year.

d.The power and electricity costs of running a machine were treated as an expense for the year.The costs amounted to $56,000.

e.The costs of insuring a piece of equipment while it was in transit amounted to $5,000,and those costs were capitalized.

Required:

1.List any errors that you find.

2.Correct the errors and prepare another income statement.

Definitions:

Goods

Tangible items that are manufactured or produced for sale.

Voidable Title

A legal status indicating that a title to ownership can be rendered void or cancelled due to certain defects or fraud, but remains valid until annulled.

Bad Check

A check that cannot be processed because the account on which it is drawn does not have sufficient funds.

Seller Transfers

The act of a seller handing over the rights, responsibilities, and ownership of products or property to the buyer.

Q4: When Y Company later records the write-off

Q6: Magic Cow Co.made a sale for $5,000

Q21: The main objective of the lower-of-cost-or-market rule

Q102: The Multiplex Mart accepts VISA.During March,$140,000 in

Q105: Prima,Inc.issued 15-year bonds with a face value

Q186: The following information is from the accounting

Q207: The term accounts receivable is used to

Q210: In times of rising prices,a company that

Q213: On January 1,2011,Ace Electronics paid $400,000 cash

Q228: Warranty expense is recognized when products are