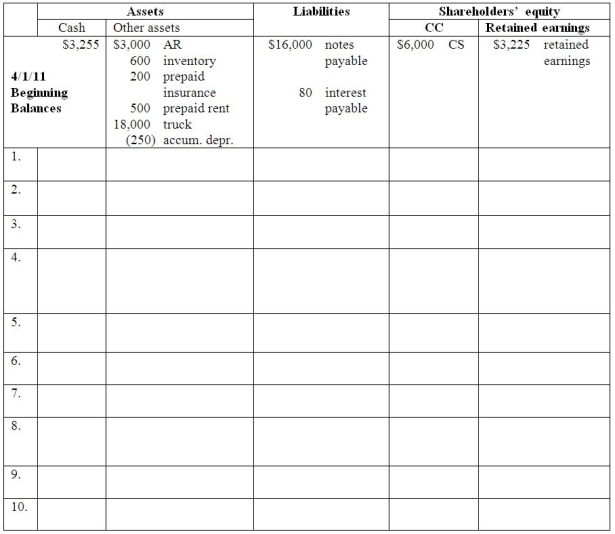

Part A:

Enter the April 2011 transactions and adjustments for Tim's Tams in the accounting equation.

1.April 1 Collected $3,000 of accounts receivable from March sales.

2.April 2 Purchased 1,200 caps @ $6 each on account.

3.April 6 Paid $700 cash for office supplies.

4.April 20 Tim's Tams sold 800 baseball caps @ $10 each on account.Cost of goods sold was $4,800.

5.April 30 Tim's Tams declared and paid a $400 cash dividend to its shareholder.

6.April 30 Adjusted for insurance used during the month.On February 1,Tim's Tams paid $600 for 3 months of insurance coverage that began February 1.

7.April 30 Adjusted for rent used during the month.Last month Tim's Tams paid $1,000 for two months' rent.

8.April 30 Recorded one month's straight-line depreciation on the $18,000 truck that has a 6-year useful life and no salvage value.

9.April 30 Counted the office supplies and found that $200 of supplies have not been used.

10.April 30 Recorded interest on the $16,000,4-month,6% note payable for the month.  Parts B,C,D and E: Complete the financial statements.

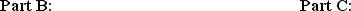

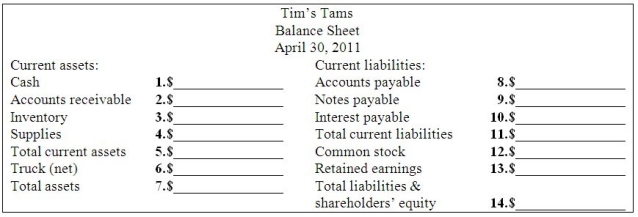

Parts B,C,D and E: Complete the financial statements.

Part D:

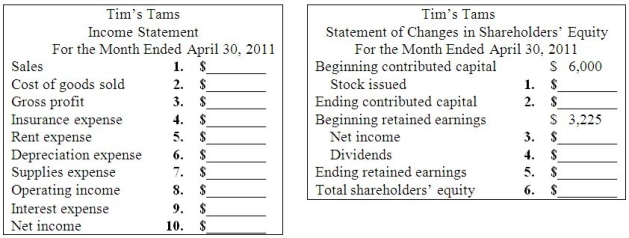

Part D:  Part E:

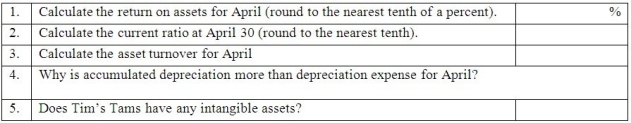

Part E:  Part F: Using the financial statements above,answer the following questions:

Part F: Using the financial statements above,answer the following questions:

Definitions:

Output

The total amount of goods or services produced by an individual, firm, or country within a given period.

Compact Disc Inputs

Not a standard economic key term, likely refers to inputs required for the production of compact discs as part of a business's operations.

Larger Percentage Increase

A situation where the rate of increase in a particular variable is higher relative to other comparable measures or periods.

Average Costs

The total cost of production divided by the number of units produced, giving the cost per unit of production.

Q8: How many of the following depreciation methods

Q59: Use the following selected information from ABC

Q63: Team instructions: Provide students with copies of

Q118: On November 27,Acme,Inc.ordered merchandise from Zenith Company.Zenith

Q137: WDS Company owns a patent with an

Q147: Thyme,Inc.'s inventory turnover ratio has been approximately

Q213: On January 1,2011,Ace Electronics paid $400,000 cash

Q215: The accountants for QEE Systems use the

Q245: Assume Taylor & Sons Cabinet Makers has

Q271: Jason Argo is making plans to finance