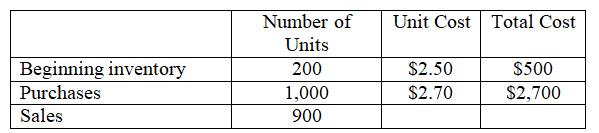

The following information is from the accounting records of JackCo:

Required:

1. Determine the cost of goods sold assuming JackCo uses the first-in, first-out (FIFO) inventory method.

2. Determine the cost of goods sold assuming JackCo uses the last-in, first-out (LIFO) inventory method.

3. Which inventory method results in LOWER taxable income for the period? Why?

Definitions:

Q2: Eta Co.experienced the following events during the

Q34: What is the effect of the adjusting

Q45: On January 1,2011,Nadir Company issued $1,000,000 of

Q54: The employees of Dew Drop Inn get

Q71: Explain why certain long-term assets are depreciated,amortized,or

Q84: X Company used the following items to

Q109: Put an X in the appropriate box

Q148: Able Company bought a machine on January

Q171: Philipsburg Corporation sells mugs to fine retailers

Q294: Tina's Wear issued 10-year bonds with a