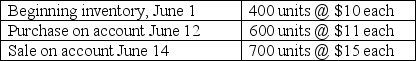

Merits,Inc.'s inventory activity in June was as follows:

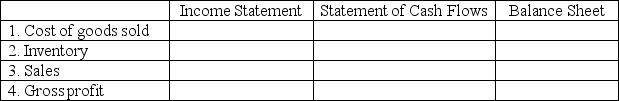

Part A: Choose the column that represents the June financial statement where the line item will appear and fill in the dollar amount using the LIFO inventory method.

Part A: Choose the column that represents the June financial statement where the line item will appear and fill in the dollar amount using the LIFO inventory method.

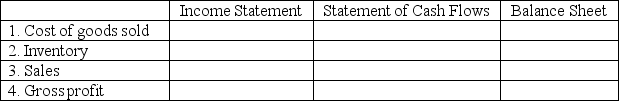

Part B: Choose the column that represents the June financial statement where the line item will appear and fill in the dollar amount using the FIFO inventory method.

Part B: Choose the column that represents the June financial statement where the line item will appear and fill in the dollar amount using the FIFO inventory method.

Definitions:

Straight-Line Method

A method of calculating depreciation for an asset, spreading the cost evenly over its useful life.

Depreciation Expense

It is an accounting method of allocating the cost of a tangible asset over its useful life.

Residual Value

The estimated amount that an asset will realize upon its disposal at the end of its useful life.

Straight-Line Depreciation

A method of calculating the depreciation of an asset evenly over its useful life, assigning a fixed expense amount to every accounting period.

Q1: On May 1,2012,Mink,Inc.borrowed $10,000 by issuing a

Q6: Inside Outfitters sold $200 of merchandise to

Q15: Maxine's Equipment Company had $400,000 in total

Q29: Sally has a new VISA card that

Q31: On January 1,2010,We Haul,Inc.bought a $48,000 truck,which

Q104: Employees who sign checks should not record

Q105: Adjustments are usually made _.<br>A)in the accounting

Q216: Which financial statement shows Salaries expense?<br>A)Income statement<br>B)Statement

Q217: Umatilla Tile Company compiled the following inventory

Q235: Z Company uses a periodic inventory system.If