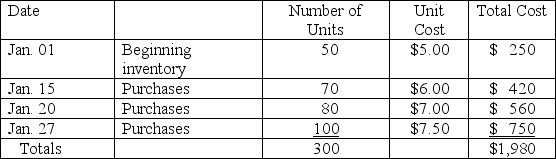

Inventory data for Army & Navy Wear Co.are provided below.Sales for the month were 220 units sold for $12 each.The company maintains a periodic inventory system.

Required:

Required:

1.Determine the cost of goods sold and ending inventory for the month assuming the company uses the FIFO cost flow method.

2.Determine the cost of goods sold and ending inventory for the month assuming the company uses the LIFO cost flow method.

3.Determine the cost of goods sold and ending inventory for the month assuming the company uses the weighted average method.

4.Which method would you recommend that the company use if its objective is to minimize its income tax liability?

Definitions:

Merchandise Inventory

Goods available for sale to customers, categorized as a current asset on a company's balance sheet.

Invoice Cost

The price of goods or services listed on an invoice, typically inclusive of fees and charges before any discounts.

Incidental Costs

Incidental costs refer to minor or secondary expenses that are not planned for but occur in the course of conducting business.

LIFO

Last In, First Out, an inventory valuation method where the most recently produced items are recorded as sold first.

Q8: The allowance method is preferred over the

Q28: International Financial Reporting Standards (IFRS)require revaluation of

Q29: On January 1,2011,Alpha Company issued $1,000,000 of

Q33: Which method requires the unit cost is

Q39: In times of rising prices,a company that

Q95: In a time of rising prices,the main

Q115: Mac,Inc.purchased a truck on October 1,2011 in

Q144: The primary risk associated with long-term debt

Q174: Which of the following companies will probably

Q209: On January 1,2011,Tiler Company purchased equipment that