Team Instructions: Divide the class into teams of three or four people.Each team member should work the following problem separately outside of class.Then give the students time in class to compare answers with their teammates and put together a final correct copy of the problem.Each team should turn in only one copy of the problem for grading,along with the annual report that they used.All team members will receive the same grade.

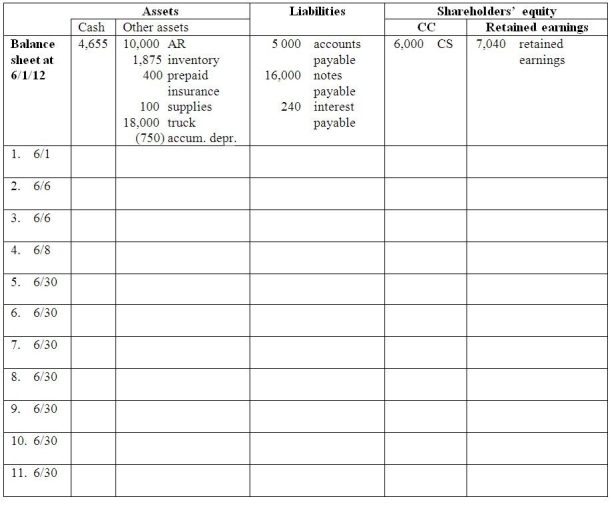

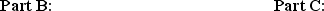

Part A: Enter the June 2012 transactions and adjustments for Tim's Tams,Inc.in the accounting equation below.

1.June 1 Collected $10,000 of accounts receivable from May sales

2.June 6 Paid $5,000 of its accounts payable from May purchases

3.June 6 Paid $600 cash for supplies.

4.June 8 Purchased 1,000 caps for $6,350 on account

5.June 30 During June,Tim's Tams sold 1,000 baseball caps for $10 each on account.Cost of goods sold was $6,320.

6.June 30 Tim's Tams declared and paid a $4,000 cash dividend to its shareholder.

7.June 30 Adjusted for insurance used during the month.Recall that on May 1,Tim's paid $600 for 3 months of insurance coverage.

8.June 30 Counted the office supplies and found that $400 of supplies have not been used.

11.June 30 Recorded interest on the $16,000,4-month,6% note payable for the month

11.June 30 Recorded interest on the $16,000,4-month,6% note payable for the month

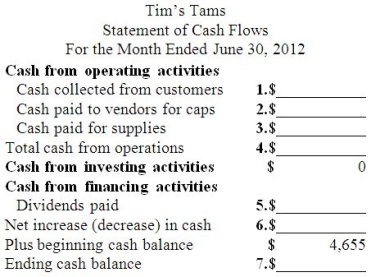

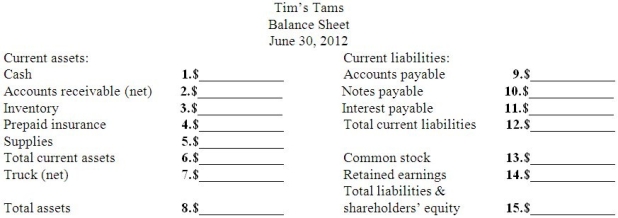

Part D:

Part D:  Part E:

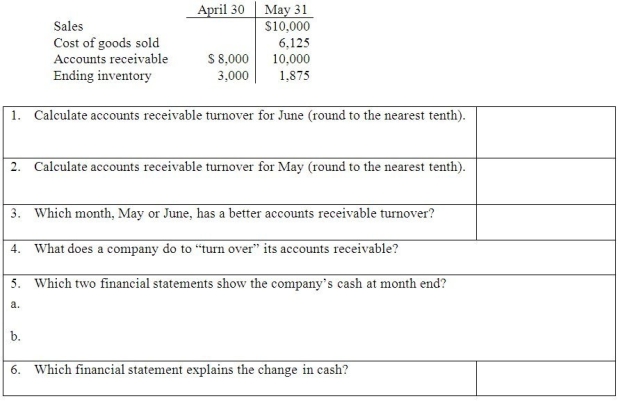

Part E:  Part F: The following information from April and May might be useful in answering some of the questions below:

Part F: The following information from April and May might be useful in answering some of the questions below:

Definitions:

Advanced Administrative Duty

Tasks or responsibilities assigned to high-level administrative positions that involve complex management or oversight roles.

STAT Laboratory Tests

STAT laboratory tests refer to diagnostic testing that is urgently performed to obtain rapid results for critical patient care decisions.

Scope Of Practice

The procedures, processes, and actions a healthcare worker is allowed to perform under the terms of his or her professional license.

State Law

Legislation that is enacted and enforced by a particular state within a country, governing within its boundaries.

Q34: For June,Team Shirts had a beginning balance

Q41: The Financial Accounting Standards Board sets international

Q41: Horse Creek Company had beginning inventory of

Q45: On July 1,2012,Homer,Inc.loaned a customer $10,000 on

Q47: to its monthly magazine Minks Stink.The company

Q95: The owners of a corporation are called

Q120: Liquidity _.<br>A)represents the amount of financial risk

Q170: On June 1,beginning inventory consists of ten

Q179: Using the following income statement,calculate the profit

Q204: An accounting clerk compares a bill received