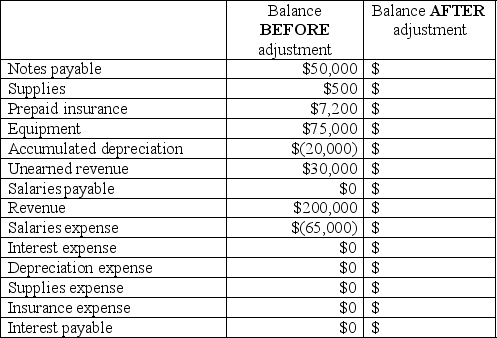

Selected data from Olympia,Inc.'s accounting system are provided below.All balances are BEFORE year-end adjustments and all data relate to the year ended Dec.31,2011.Complete the chart below to show the balances in each of the accounts AFTER the appropriate adjustments have been made,using the following additional information:

a.The note was issued on October 31,2011 at 12%.Both interest and principal are due on April 1,2012.

b.The equipment was purchased on January 1,2010.It has a seven-year estimated useful life with a $5,000 estimated residual value.

c.$300 of the supplies were used during the year.

d.The prepaid insurance balance relates to a $7,200,12-month policy purchased on April 1,2011.

e.$20,000 of the unearned revenue is now earned.

f.The salaries expense account balance does not include $10,000 of employee salaries earned but unpaid.

Definitions:

Insurance Settlement

An insurance settlement is the payment made by an insurance company to a claimant, policyholder, or a designated recipient as compensation for a covered loss or policy event.

Interest Rate

The percentage charged or paid for the use of money on a yearly basis.

Guaranteed

A commitment or assurance, often by a third party, that certain conditions will be fulfilled, including payments or the performance of contractual obligations.

Interest Rate

The rate at which a portion of money is applied as a fee for its loan, commonly expressed per annum.

Q4: Most accounting policy choices affect both the

Q21: On May 31,Team Shirts pays a $600

Q27: State the most applicable accounting rule for

Q72: Wal-Mart is an example of a merchandising

Q77: Many of the largest CPA firms are

Q85: Profit is the difference between sales and

Q112: Sales for August for Team Shirts were

Q125: Credit card sales benefit companies because _.<br>A)the

Q140: Recording revenue before it is earned will

Q206: The bookkeeper of Dew Drop Inn forgets