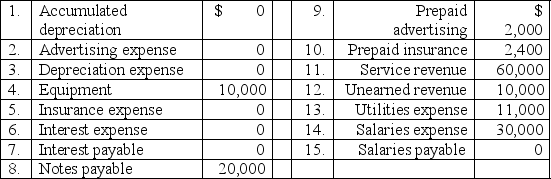

The records of Adam's Apple,Inc.revealed the following amounts at December 31,2011 before adjustments:

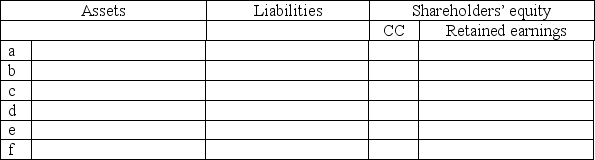

Part A: In the worksheet below,record the effect of these six adjustments on the accounting equation.Show the correct dollar amounts,and write in the titles of the accounts affected.

Part A: In the worksheet below,record the effect of these six adjustments on the accounting equation.Show the correct dollar amounts,and write in the titles of the accounts affected.

a.$400 of the advertising paid in advance remained unused.

b.The equipment,purchased on January 1,has a useful life of 5 years with no residual value.Record the depreciation for the year.

c.Four months of the 12-month insurance policy have NOT expired.

d.Interest is owed on the 6%,9-month note issued on November 1,2011.

e.$6,000 was earned of the amounts collected in advance from customers.

f.$4,000 was owed to employees for work done in December.

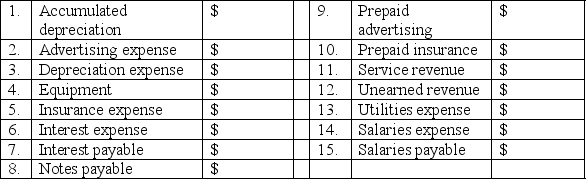

Part B: Fill in the adjusted balances as of December 31,2011:

Part B: Fill in the adjusted balances as of December 31,2011:

Part C: Calculate Adam's Apple's net income for the year ended December 31,2011.$________

Part C: Calculate Adam's Apple's net income for the year ended December 31,2011.$________

Definitions:

Aerobic Respiration

A metabolic process in which cells use oxygen to break down glucose and other molecules, producing carbon dioxide, water, and energy in the form of ATP.

Selective Advantage

A genetic or behavioral characteristic that improves an organism's ability to survive and reproduce in its environment.

Oxygen

A chemical element with symbol O and atomic number 8, essential for aerobic respiration in living organisms and a component of the Earth's atmosphere.

Multicellular Eukaryote

An organism made up of multiple cells that have a nucleus and organelles, including animals, plants, and fungi.

Q2: Clean Sweep agreed to clean an office

Q71: Information that is relevant is both timely

Q91: The stock exchange is _.<br>A)where all companies

Q94: Why would the Unearned revenue account need

Q105: Adjustments are usually made _.<br>A)in the accounting

Q142: Acme,Inc.accepted a promissory note from NadirCo,who promised

Q158: Use the following data to answer the

Q164: Gross profit equals _.<br>A)sales minus cost of

Q168: The Magic Cow accepts MasterCard.A customer made

Q209: The following is a partial list of