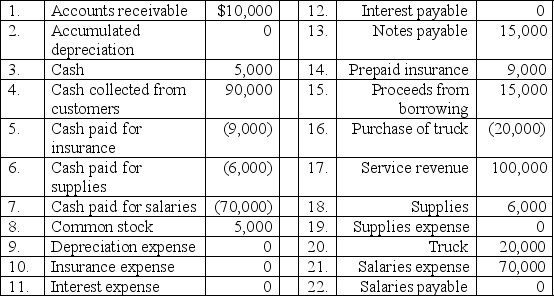

Airing & Spelling,Inc.began operations on January 1,2011.The following amounts were obtained from its information system on December 31,2011.These amounts are before any year-end adjustments have been made:

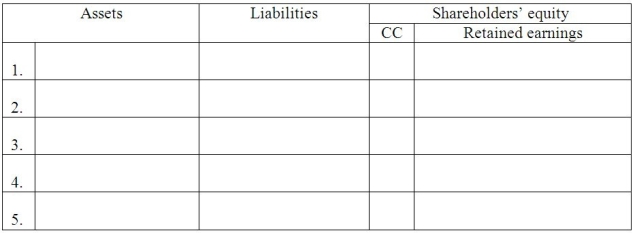

Part A: In the worksheet below,record the effect of these five adjustments on the accounting equation.Show the correct dollar amounts,and write in the titles of the accounts affected.

Part A: In the worksheet below,record the effect of these five adjustments on the accounting equation.Show the correct dollar amounts,and write in the titles of the accounts affected.

1.The truck,purchased on January 1,has a useful life of 5 years with no residual value.Record the depreciation for the year.

2.The 6%,two-year notes payable were issued on January 1.Interest and principal are due January 1,2013.

3.Insurance coverage used during the year was $6,000.

4.$500 worth of supplies were on hand at December 31.

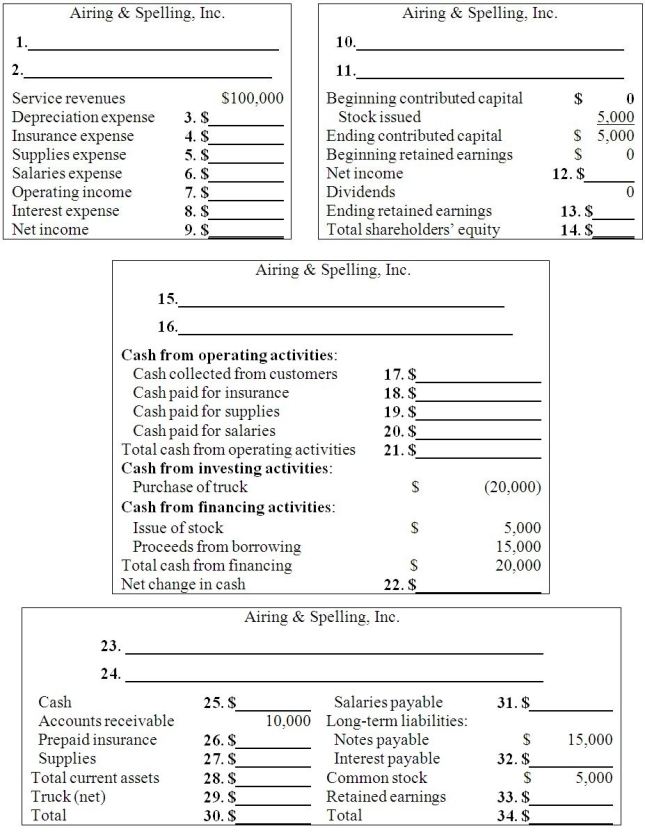

5.Additional salaries of $10,000 were earned and will be paid next month.  Part B: Fill in the missing information on the financial statements:

Part B: Fill in the missing information on the financial statements:  Part C: Calculate the profit margin on sales ratio.______________________

Part C: Calculate the profit margin on sales ratio.______________________

Definitions:

Dutch Revolt

The 16th-century rebellion in the Netherlands against the Spanish Empire, leading to the independence of the Dutch Republic.

Economic Reasons

The motivations or factors related to financial gains, economic stability, or the pursuit of wealth that influence decisions or policies.

Religious Reasons

Motivations or justifications for actions, policies, or beliefs based on religious faith, doctrines, or interpretations.

Defenestration of Prague

A historical incident in 1618 where two Catholic officials were thrown out of a window in Prague, sparking the Thirty Years' War.

Q35: C.D.Lee was preparing the monthly bank reconciliation

Q69: Use the following code to classify the

Q71: Midway Company had a balance of $(500)in

Q75: The Internal Revenue Service (IRS)is the governmental

Q86: The FASB,or Financial Accounting Standards Board,is currently

Q86: In a corporation,dividends distributed to owners are

Q102: The Multiplex Mart accepts VISA.During March,$140,000 in

Q175: Classify the following accounts according to the

Q186: Show the effects of each of the

Q226: Sales revenue is usually considered earned when