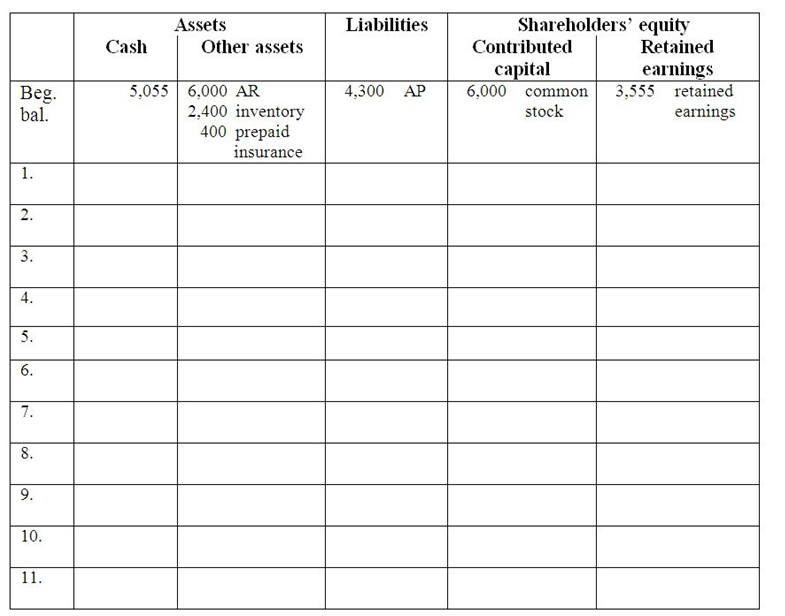

Part A: Enter the March transactions and adjustments in the accounting equation below.

1. March 1 Collected $6,000 of its accounts receivable from February sales.

2. March 1 Tim’s Tams paid $1,000 for two months’ rent beginning March 1.

3. March 1 Borrowed $16,000 on a 4-month, 6% note payable.

4. March 1 Paid $18,000 cash for a truck that has an estimated useful life of 6 years with no salvage value.

5. March 6 Paid $4,300 of its accounts payable from the caps purchased in February.

6. March 20 Tim’s Tams sold 300 baseball caps @ $10.00 each on account. The caps cost $6 each.

7. March 31 Tim’s Tams declared and paid a $500 cash dividend to its shareholder.

8. March 31 Adjusted for insurance used during the month. Recall that on February 1, Tim’s Tams paid $600 for 3 months of insurance coverage that began February 1.

9. March 31 Adjusted for rent used during the month. Recall that Tim’s Tams paid $1,000 for two months’ rent.

10. March 31 Recorded one month’s depreciation on the $18,000 truck that has a 6-year useful life.

11. March 31 Recorded interest on the $16,000, 4-month, 6% note payable for the month.

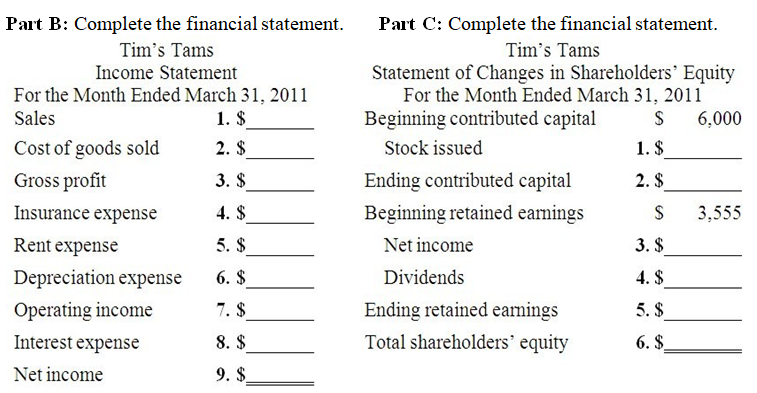

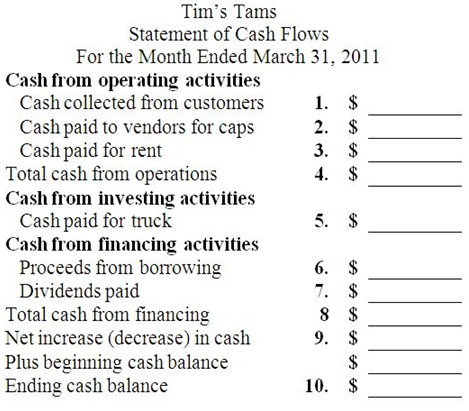

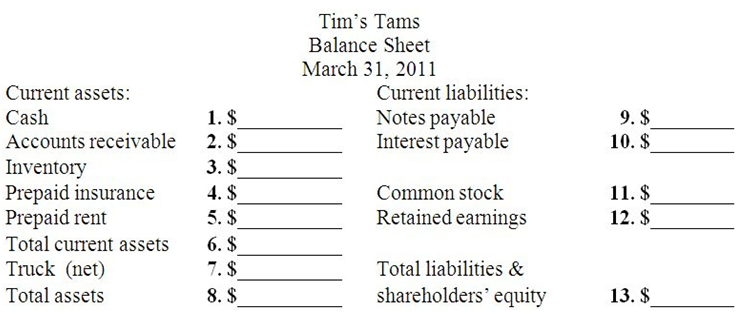

Part D: Complete the financial statement.

Part E:

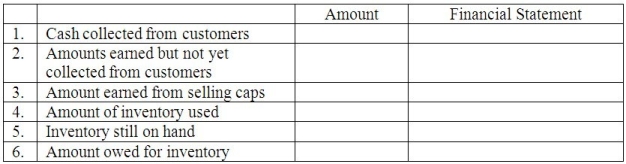

Part F: For each item, write in the amount (even if $0) as of or for the Month ended March 31, 2011 and write in the one financial statement where the line item is found: Part G: Use the transactions and financial statements to answer the following:

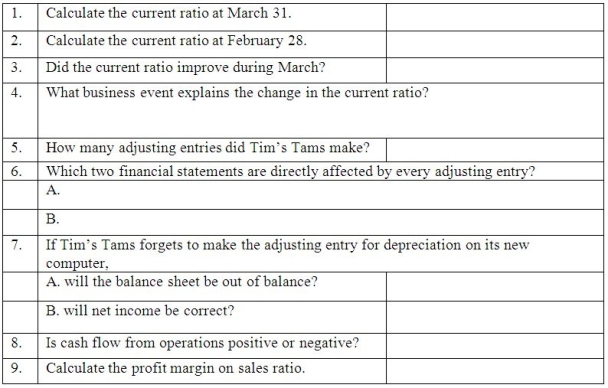

Part G: Use the transactions and financial statements to answer the following:

Definitions:

Growth Rate

A measure of the increase in size, number, value, or strength of something over a specific period of time.

Beta

An indicator of the degree to which a particular stock's movement is volatile compared to the general market, conveying the risk level of the stock relative to the market norm.

Risk-Free Rate

A return on an investment that is guaranteed not to result in financial loss, usually tied to state bonds.

Expected Return

The anticipated profit or loss from an investment, taking into consideration the potential outcomes and their probabilities.

Q4: On January 1,2011,Swinger,Inc.purchases a batting machine for

Q39: Most accounting policy choices affect both the

Q54: The law firm of Doolittle and Baroque

Q122: The sales method for estimating bad debts

Q124: Revenue minus expenses equals gross profit.

Q131: The August bank statement for Midway Company

Q155: Miss Hap,the inexperienced accountant,made the following adjustments

Q164: Why are credit card sales important to

Q181: Describe the accrual basis of accounting.

Q190: Where should a user of accounting information