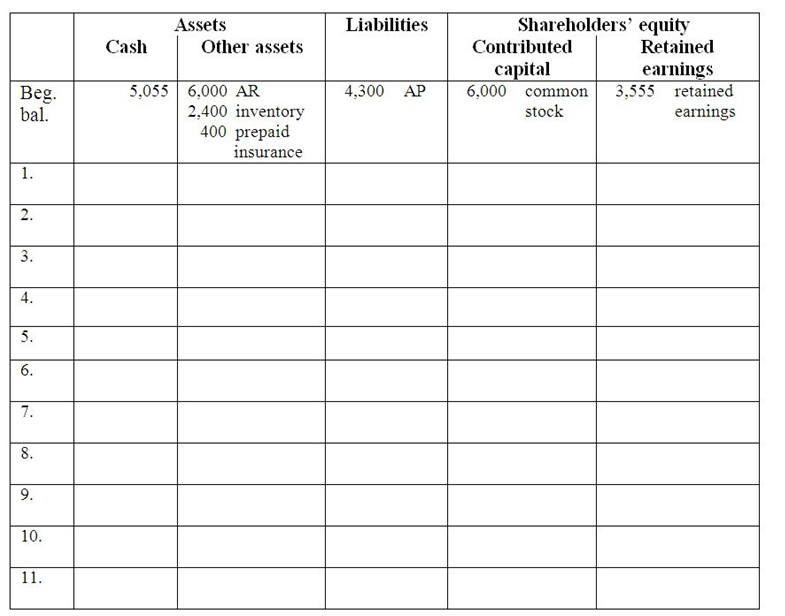

Part A: Enter the March transactions and adjustments in the accounting equation below.

1. March 1 Collected $6,000 of its accounts receivable from February sales.

2. March 1 Tim’s Tams paid $1,000 for two months’ rent beginning March 1.

3. March 1 Borrowed $16,000 on a 4-month, 6% note payable.

4. March 1 Paid $18,000 cash for a truck that has an estimated useful life of 6 years with no salvage value.

5. March 6 Paid $4,300 of its accounts payable from the caps purchased in February.

6. March 20 Tim’s Tams sold 300 baseball caps @ $10.00 each on account. The caps cost $6 each.

7. March 31 Tim’s Tams declared and paid a $500 cash dividend to its shareholder.

8. March 31 Adjusted for insurance used during the month. Recall that on February 1, Tim’s Tams paid $600 for 3 months of insurance coverage that began February 1.

9. March 31 Adjusted for rent used during the month. Recall that Tim’s Tams paid $1,000 for two months’ rent.

10. March 31 Recorded one month’s depreciation on the $18,000 truck that has a 6-year useful life.

11. March 31 Recorded interest on the $16,000, 4-month, 6% note payable for the month.

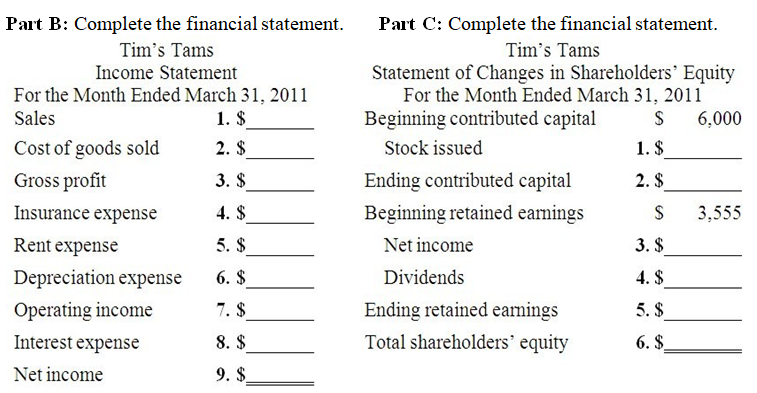

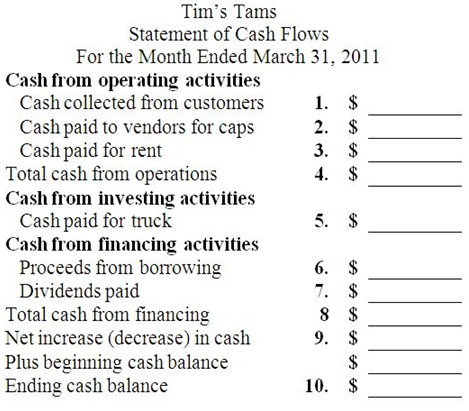

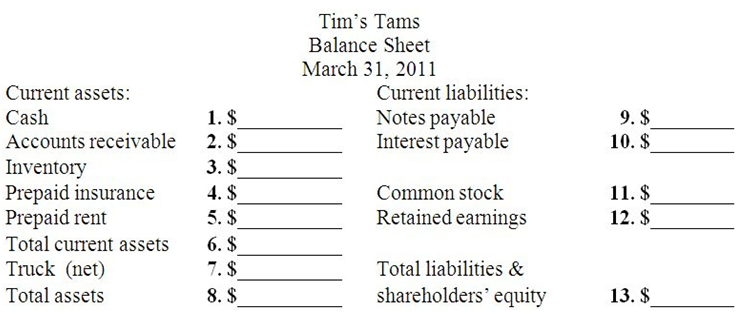

Part D: Complete the financial statement.

Part E:

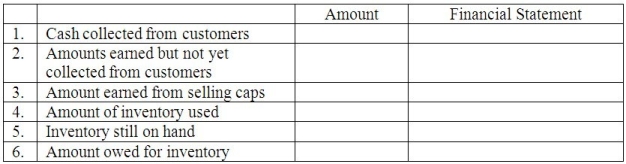

Part F: For each item, write in the amount (even if $0) as of or for the Month ended March 31, 2011 and write in the one financial statement where the line item is found: Part G: Use the transactions and financial statements to answer the following:

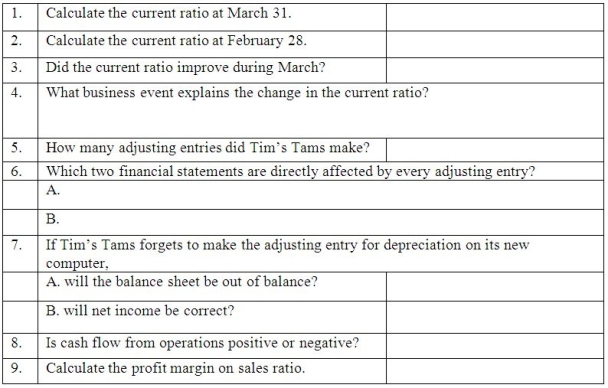

Part G: Use the transactions and financial statements to answer the following:

Definitions:

Low-Context Culture

Culture in which people derive much information from the words of a message and less information from nonverbal and environmental cues.

High-Context Culture

Culture in which people derive much information from nonverbal and environmental cues.

Stereotyping

The act of attributing specific characteristics or behaviors to individuals based solely on their membership in a particular group.

Prejudice

Preconceived opinions or judgments about individuals or groups that are typically negative and formed without factual basis.

Q4: Ace Electronics bought a new factory for

Q14: Mia Hero started her own catering business

Q20: Most accounting policy choices affect both the

Q47: In 2011,Seven Seas sold $20,000 worth of

Q87: Airing & Spelling,Inc.began operations on January 1,2011.The

Q91: Enoch,Inc.began operations on July 1,2011.On August 1,it

Q159: A sole proprietorship has more than one

Q159: South Sea's sales were $60,000 for 2011

Q171: Brooke's Bikes sold $11,235 worth of mountain

Q259: Explain the matching principle.