Team Instructions: Divide the class into teams of three or four people.Each team member should work the following problem separately outside of class.Then give the students time in class to compare answers with their teammates and put together a final correct copy of the problem.Each team should turn in only one copy of the problem for grading.All team members will receive the same grade.

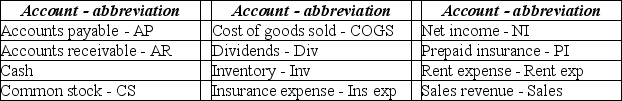

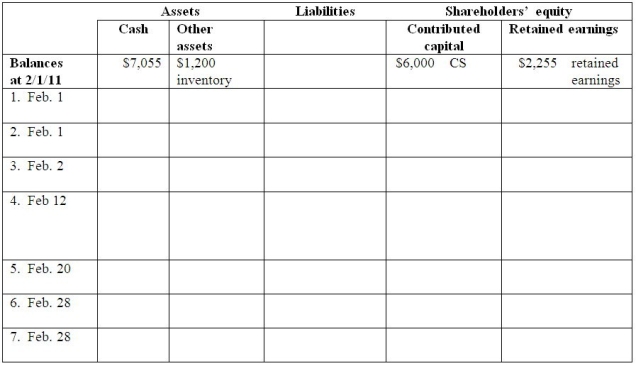

Part A: Record the transactions below by filling in the amount and the account title from the list of accounts below (use the abbreviations given):

1.February 1 Tim's Tams paid $800 for February's rent of a booth.

1.February 1 Tim's Tams paid $800 for February's rent of a booth.

2.February 1 Tim's Tams paid $600 cash for three months of insurance coverage that begins February 1.

3.February 2 Tim's Tams purchased 800 baseball caps that cost $6.00 each on account.

4.February 12 Tim's Tams sold 600 baseball caps @ $10.00 each on account.

Record both a)the sale and b)the cost of the sale.

5.February 20 Tim's Tams paid for $500 of the caps purchased on February 2.

6.February 28 Tim's Tams declared and paid a $100 cash dividend to its shareholder.

7.February 28 Adjusted for insurance used during the month.  Parts B,C,D and E:

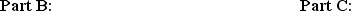

Parts B,C,D and E:

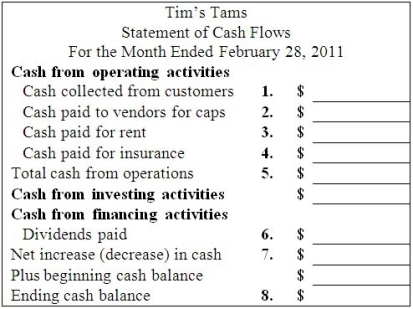

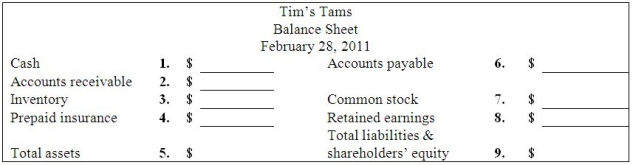

Complete the four financial statements:

Part D:

Part D:  Part E:

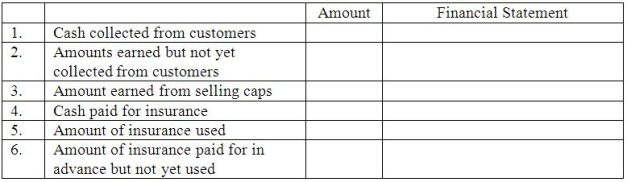

Part E:  Part F: For each description,write in the amount and show on which of the February financial statements this information is found.

Part F: For each description,write in the amount and show on which of the February financial statements this information is found.  Part G: Using the financial statements above,answer the following:

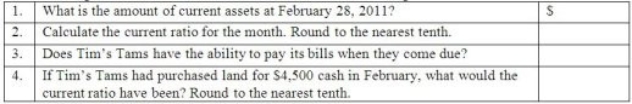

Part G: Using the financial statements above,answer the following:

Definitions:

Net Markdowns

The reduction in the original selling price of merchandise minus any markdown cancellations.

FOB Shipping Point

A shipping term indicating that the buyer assumes ownership and responsibility for goods at the moment they are shipped, with transportation costs borne by the buyer.

Net Income

The total earnings or profit of a company after all expenses have been deducted from revenues.

Physical Inventory

The process of counting and verifying the physical existence of tangible goods and assets held by a business for resale or production purposes.

Q2: What difference would there be to profit

Q5: What would be the effect on the

Q5: An accountant discovered a bank error while

Q7: Income tax expense was $200,000 for the

Q24: Springtown Ltd issued 10 000 ordinary shares

Q39: Which of the ratios listed helps to

Q48: The amount of inventory purchased during the

Q96: Wok 'N' Roll,Inc.,has assets of $500,000 and

Q121: Dell Inc.'s distribution of earnings to owners

Q172: The accounting rule which requires that only