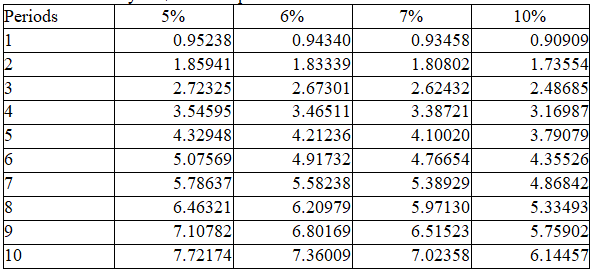

Use the following tables to calculate the present value of a $25,000, 7%, 5-year bond that pays $1,750 $25,000 × 7% interest annually, if the market rate of interest is 7%

Present Value of $1 at Compound Interest

Present Value of Annuity of $1 at Compound Interest

Definitions:

Weighted-Average Method

An inventory costing method that calculates the cost of ending inventory and the cost of goods sold based on the weighted average of all costs of goods available for sale.

Conversion Costs

Costs incurred in the process of converting raw materials into finished products, typically including labor and overhead expenses.

Weighted-Average Method

A cost accounting method that calculates inventory and the cost of goods sold based on the average cost of all similar items in inventory.

First-In-First-Out (FIFO)

An inventory valuation method where the first items produced or acquired are the first to be sold or used, reflecting the chronological flow of goods.

Q21: The double-declining balance rate for calculating depreciation

Q28: If a corporation is liquidated,preferred stockholders are

Q43: Which intangible assets are amortized over their

Q48: If a fixed asset,such as a computer,were

Q80: Skyline,Inc.purchased a portfolio of trading securities

Q111: On July 5,Winter Company had a market

Q120: Under the cost method,when treasury stock is

Q153: The following information was taken from

Q155: Which of the following would be used

Q165: On April 15,Compton Co.paid $2,800 to upgrade