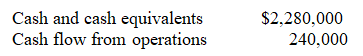

Groceries R Us,Inc.reported the following data in its annual report.

a What is the company's "cash burn" per month?

b What is the company's ratio of cash to monthly cash expenses?

c Interpret the ratio you computed in part 2.What are the implications for Groceries R Us,Inc.?

Definitions:

Strip Bond

A debt security that has had its main components, such as principal and coupon payments, separated into individual parts and sold as zero-coupon bonds.

Yield Rate

The annual return on an investment, expressed as a percentage of the investment's cost.

Compounded Semi-annually

This refers to the process of calculating interest on an investment or loan, with the interest being added to the principal balance twice a year, typically every six months.

Strip Bond

A bond where both the principal and regular interest payments have been separated and are sold individually.

Q1: When a seller allows a buyer an

Q12: Which of the following is true?<br>A)If using

Q34: If Addison uses LIFO,the cost of the

Q43: The retained earnings statement shows<br>A)only net income,beginning

Q75: Assuming that the company uses the perpetual

Q75: A business that requires all cash payments

Q80: Taking advantage of a 2/10,n/30 purchases discount

Q85: The inventory costing method that reports the

Q132: A petty cash fund is used to

Q134: Based upon the following data,estimate the cost