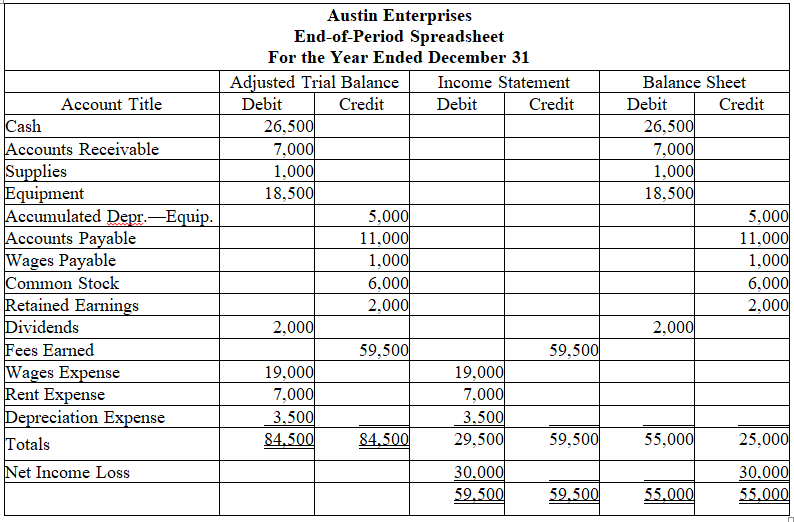

During the current year,Austin Enterprise shareholders invested $8,000 in the business.Based on the following end-of-year spreadsheet,prepare an income statement for Austin Enterprises for the year ended December 31.

Definitions:

Total Product Cost

The sum of all costs directly or indirectly associated with producing a product, including materials, labor, and overhead.

Activity-Based Costing

A costing method that assigns overhead and indirect costs to specific products or services based on the activities and resources that go into their production.

Direct Labor Cost

Refers to the total amount paid to workers directly involved in the production of goods or services, including wages and other related expenses.

Predetermined Overhead Rate

An estimated rate used to charge overhead costs to products or job orders, based on a selected allocation base anticipated before the accounting period.

Q8: Freight-in is considered a cost of purchasing

Q11: Gadget Palace is a retailer selling unique

Q30: Inventory turnover measures the length of time

Q30: Because many companies use computerized accounting systems,periodic

Q54: When merchandise sold is assumed to be

Q65: When preparing an income statement vertical analysis,each

Q75: Some of the major fraudulent acts by

Q101: Using accrual accounting,expenses are recorded and reported

Q133: The entry to close expenses would be:

Q146: Inventory shrinkage is recorded when<br>A)merchandise is returned