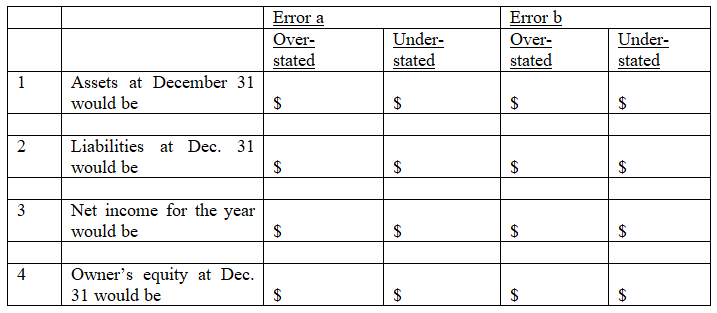

At the end of the fiscal year,the following adjusting entries were omitted:

a. No adjusting entry was made to transfer the $1,750 of prepaid insurance from the asset account to the expense account.

b. No adjusting entry was made to record accrued fees of $525 for services provided to customers.

Assuming that financial statements are prepared before the errors are discovered,indicate the effect of each error,considered individually,by inserting the dollar amount in the appropriate spaces.Insert "0" if the error does not affect the item.

Definitions:

Adding Value

The process of enhancing a product or service to make it more attractive to customers, thereby increasing its worth.

Venture Capital Firm

A company that invests in startups and early-stage companies with high growth potential in exchange for equity.

Entrepreneur

An individual who organizes, operates, and assumes the risk for a venture, innovating and transforming ideas into economically viable entities.

Tax Exposure

The degree to which an individual or organization is subject to taxes or the risk of tax-related liabilities.

Q18: Which of these is a typical source

Q33: In the event of insolvency,subordinated debt ranks:<br>A)below

Q36: Dividends decrease stockholders' equity and are listed

Q54: When reporting on divisional performance,the format generally

Q55: In the chart of accounts,each account number

Q61: Journalize the following transactions for the Evans

Q68: Adjusting journal entries are dated on the

Q85: For each of the following,calculate the cost

Q87: What effect will this adjusting journal entry

Q101: Which of the items below does not