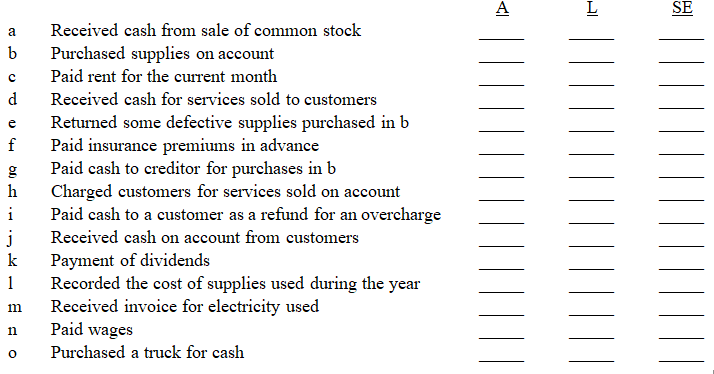

Selected transactions completed by a corporation are described below.Indicate the effects of each transaction on assets,liabilities,and stockholders' equity by inserting "+" for increase and "−" for decrease in the appropriate columns at the right.If appropriate,you may insert more than one symbol in a column.

Definitions:

Income Tax Rate

The percentage at which income is taxed by the government, varying across income levels and jurisdictions.

Straight-Line Depreciation

A technique for distributing the expense of an asset uniformly over its lifetime.

Renovation Cost

The financial outlay involved in restoring, updating, or modifying an asset, often a building, to either improve its value or extend its life.

Initial Investments

The initial capital outlay for starting a project, acquiring an asset, or launching a business, typically including costs for equipment, inventory, and facilities.

Q19: Which statement is not true in relation

Q24: Liabilities are reported on the<br>A)income statement<br>B)retained earnings

Q26: In which of the following types of

Q31: The break-even point is calculated by dividing

Q34: The accounting rate of return (ARR)method of

Q51: Which of these is an indirect cost

Q57: The budget which shows the expected future

Q61: The format followed in the preparation of

Q69: Krammer Company has liabilities equal to one

Q106: The normal balance of revenue accounts is