If the predetermined overhead allocation rate is 85% of direct labor cost and the Polishing Department's direct labor cost for the reporting period is $20,000, the following entry would be made to record the allocation of overhead to the products processed in this department:

Definitions:

Transfer Programs

Government initiatives designed to redistribute income through taxation and social spending to support the needy, promote social equity, and reduce poverty.

Perpetuate Poverty

The continued existence of poverty due to systemic and structural factors that fail to be addressed or resolved.

Implicit Marginal Tax Rate

The rate at which additional income is taxed indirectly through phase-outs, deductions, and exemptions, affecting incentives for work and investment.

Government Transfers

Payments made by the government to individuals, without any goods or services being received in return.

Q58: Turtle Company produces t-shirts that go

Q72: What is the reason for pooling costs?<br>A)To

Q90: Assume that the S & B partnership

Q98: At Flint Company's break-even point of 9,000

Q100: What are prime costs? What are conversion

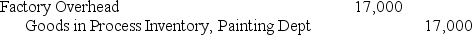

Q115: The following journal entry would be made

Q119: If the predetermined overhead allocation rates were

Q125: Use the following information to compute the

Q135: In a job order cost accounting system,

Q168: What was the cost of the direct