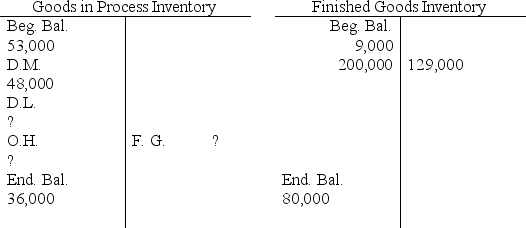

Using the following accounts and an overhead rate of 80% of direct labor cost, determine the amount of applied overhead.

Definitions:

Allowance Method

An accounting technique used to account for bad debts by estimating and recording uncollectible accounts receivable.

Outstanding Receivables

The total amount of money owed to a company by its customers for goods or services delivered but not yet paid for.

Allowance for Doubtful Accounts

A reserve for accounts receivable that may not be collectable, reducing the book value of accounts receivable to a more realistic value.

Cash Loan

A financial agreement where a borrower receives a specific amount of cash from a lender and commits to repaying it over time, along with interest.

Q33: Briefly describe how manufacturing firms dispose of

Q37: A major disadvantage of using a plantwide

Q37: Predetermined overhead rates are necessary because cost

Q58: The weighted-average method of process costing computes

Q109: Indirect labor refers to the cost of

Q142: Managerial accounting information:<br>A)Is used mainly by external

Q155: A company has two products: A1

Q156: Product costs are expenditures necessary and integral

Q170: Dividends are a type of business expense.

Q191: The Malcolm Baldrige Award was established by:<br>A)The