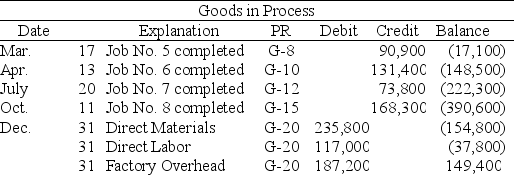

A company uses a job order cost accounting system and applies overhead on the basis of direct labor cost.At the end of a recent period, the company's Goods in Process Inventory account appeared as follows:

Write in the blanks for the following:

Write in the blanks for the following:

A.The total cost of the direct materials, direct labor, and factory overhead applied in the December 31 goods in process inventory is $_______________________.

B The company's overhead application rate is __________________%

C Job No.6 had $26,550 of direct labor cost.Therefore, the job must have had $________ of direct materials cost.

D.Job No.8 had $73,998 of direct materials cost.Therefore, the job must have had $________ of factory overhead cost.

Definitions:

Impairment Loss

The amount by which the carrying amount of an asset exceeds its recoverable amount, leading to a decrease in the asset's value on the financial statements.

International Financial Reporting Standards

A set of global accounting standards developed by the International Accounting Standards Board, aiming to bring transparency, accountability, and efficiency to financial markets around the world.

Significant Influence

The power to participate in the financial and operating policy decisions of an investee, but not control those policies, typically evidenced by ownership of 20% to 50% of the voting stock.

Fair Value

An accurate valuation of an asset or liability derived from current market conditions and agreed upon by knowledgeable, willing parties in an arm's length transaction.

Q21: The cost of partially completed products is

Q22: The Terrapin Manufacturing Company has the following

Q24: Accounting records are also referred to as

Q40: A process cost accounting system records all

Q43: To buy into an existing partnership, the

Q49: Accounting procedures for all items are the

Q68: If FIFO is used, what was the

Q75: The first step in the analyzing and

Q141: Which of the following pair of journal

Q178: What is a hybrid costing system? When