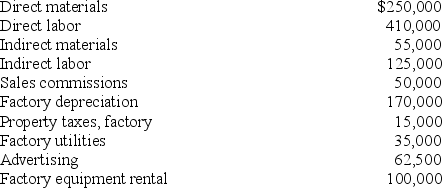

The predetermined overhead allocation rate for Forsythe, Inc.is based on estimated direct labor costs of $400,000 and estimated factory overhead of $500,000.Actual costs incurred were:

A.Calculate the predetermined overhead rate and calculate the overhead applied during the year.

B.Determine the amount of over- or underapplied overhead and prepare the journal entry to eliminate the over- or underapplied overhead assuming that it is not material in amount.

Definitions:

Gain on Sale

A financial gain that occurs when the selling price of an asset exceeds its purchase price or book value.

Stock Investment

The purchase of shares in a company with the expectation of earning a return on investment through dividends, share price appreciation, or both.

Dividend

A portion of a company's earnings distributed to shareholders as a reward for their investment.

Fair Value

An estimate of the market price for assets or liabilities, reflecting what a willing buyer would pay a willing seller in an arm's length transaction.

Q41: Rocky Industries received its telephone bill in

Q48: Fischer Company identified the following activities,

Q56: In a process costing system, factory labor

Q59: Which of the following statements is correct?<br>A)When

Q59: Factory overhead costs normally include all of

Q62: The rate established prior to the beginning

Q84: Selwyn's Service applied overhead on the basis

Q113: By definition, costs classified as overhead are

Q129: The orientation of just-in-time manufacturing is that

Q166: Explain the debt ratio and its use