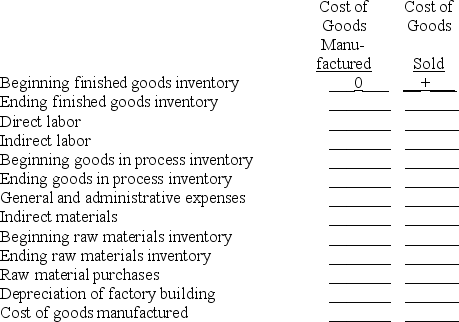

The following items for Titus Company are used to compute the cost of goods manufactured and the cost of goods sold.Indicate how each item should be used in the calculations by filling in the blanks with "+" if the item is to be added, "-" if the item is to be subtracted, or "0" if the item is not used in the calculation.The first item is completed as an example.

Definitions:

Farm Expenses

Costs associated with the operation, maintenance, and management of a farm, including but not limited to feed, seed, fertilizer, and equipment maintenance.

Total Income

Total Income refers to the combined sum of all earnings, receipts, and gains of an individual or entity during a specific period, before any deductions are made.

Chapter 7 Bankruptcy

A legal process that allows individuals or businesses to discharge most of their debts under the bankruptcy code, liquidating assets to pay off creditors.

Cash Advance

An option that allows credit card holders to withdraw a certain amount of cash immediately, often at a high interest rate.

Q3: The manufacturing statement must be prepared monthly

Q25: A manufacturer's inventory that is not completely

Q30: Shelby and Mortonson formed a partnership with

Q32: The debt ratio reflects the risk of

Q45: A company's January 1 goods in process

Q48: The comparison of a company's financial condition

Q55: The management concept of customer orientation encourages

Q93: Explain the recording and posting processes.

Q172: If a department that applies process costing

Q180: On October 1, 2011, Smith invested $20,000