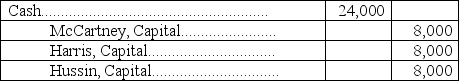

McCartney, Harris, and Hussin are dissolving their partnership.Their partnership agreement allocates each partner 1/3 of all income and losses.The current period's ending capital account balances are McCartney, $13,000; Harris, $13,000; and Hussin, $(2,000).After all assets are sold and liabilities are paid, there is $24,000 in cash to be distributed.Hussin is unable to pay the deficiency.The journal entry to record the distribution should be:

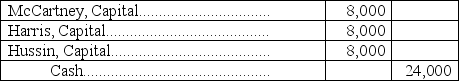

A.

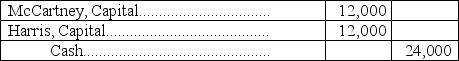

B.

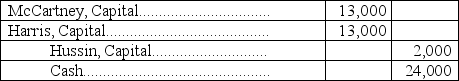

C.

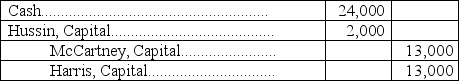

D.

E.

Definitions:

Personality Constructs

Theoretical models used to describe and understand the individual differences in people's thoughts, feelings, and behaviors.

Carl Jung

A Swiss psychiatrist and psychoanalyst who founded analytical psychology, known for concepts such as the collective unconscious and archetypes.

Object-relations Theory

A psychoanalytic theory focusing on relationships with others, suggesting that individuals relate to others based on early experiences with primary caregivers.

Unconscious Representations

Mental processes and content not immediately accessible to conscious awareness but influencing thoughts, feelings, and behaviors.

Q5: With deposits of $5,000 at the end

Q18: A manufacturing firm that produces large numbers

Q38: A company has an overhead application rate

Q71: A partnership has an unlimited life.

Q73: The total manufacturing costs incurred during the

Q74: A _ means that at least one

Q89: BVD Company uses a job order cost

Q110: Net income divided by average total assets

Q143: What is the correct amount of cost

Q153: What would be the account balance in