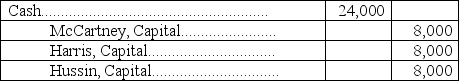

McCartney, Harris, and Hussin are dissolving their partnership.Their partnership agreement allocates each partner 1/3 of all income and losses.The current period's ending capital account balances are McCartney, $13,000; Harris, $13,000; and Hussin, $(2,000).After all assets are sold and liabilities are paid, there is $24,000 in cash to be distributed.Hussin is unable to pay the deficiency.The journal entry to record the distribution should be:

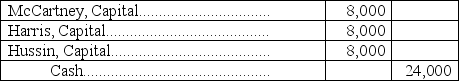

A.

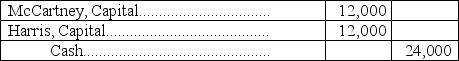

B.

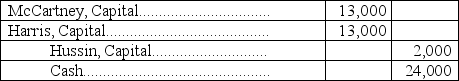

C.

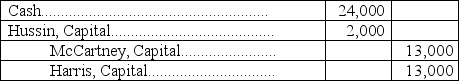

D.

E.

Definitions:

Formula For Actions

A predetermined or systematic method for determining the steps to take in a specific circumstance or to achieve a particular outcome.

Who-What-When

The "Who-What-When" framework outlines a method for capturing and organizing basic factual information, often used in planning, documentation, or analysis.

Success

is the achievement of a goal, objective, or desired outcome.

Well-Written Objective

An objective that is clear, measurable, achievable, relevant, and time-bound, guiding actions towards a specific goal.

Q9: Vertical analysis is the comparison of a

Q17: Overhead is applied as a percent of

Q55: A financial statement analysis report should include

Q64: One of the usual differences between financial

Q69: Which of the following statements is true?<br>A)Partners

Q98: Calculate the percent increases for each of

Q99: How are partners' investments in a partnership

Q137: Both financial and managerial accounting report monetary

Q178: Comparative financial statements are reports that show

Q195: In which of the following situations would