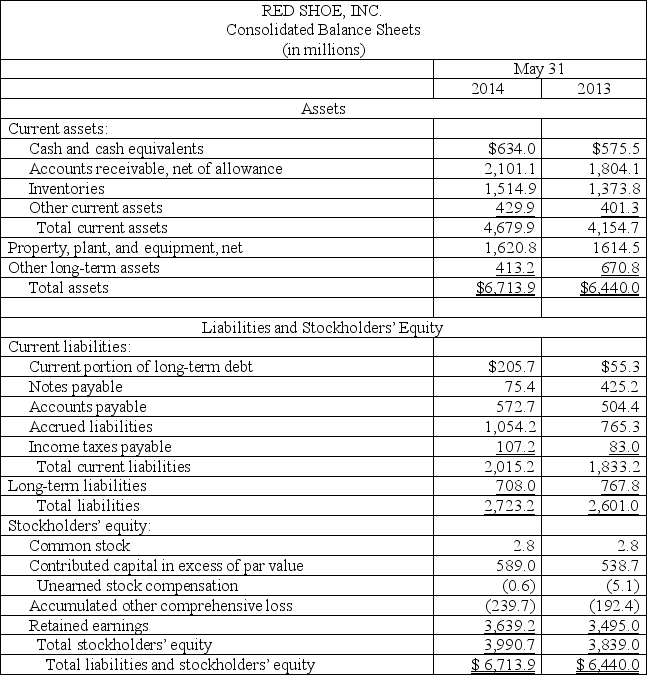

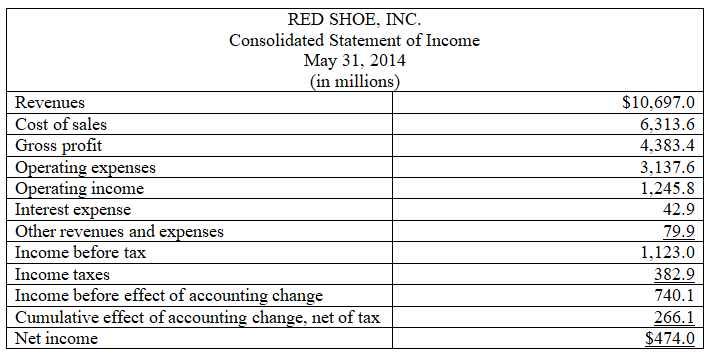

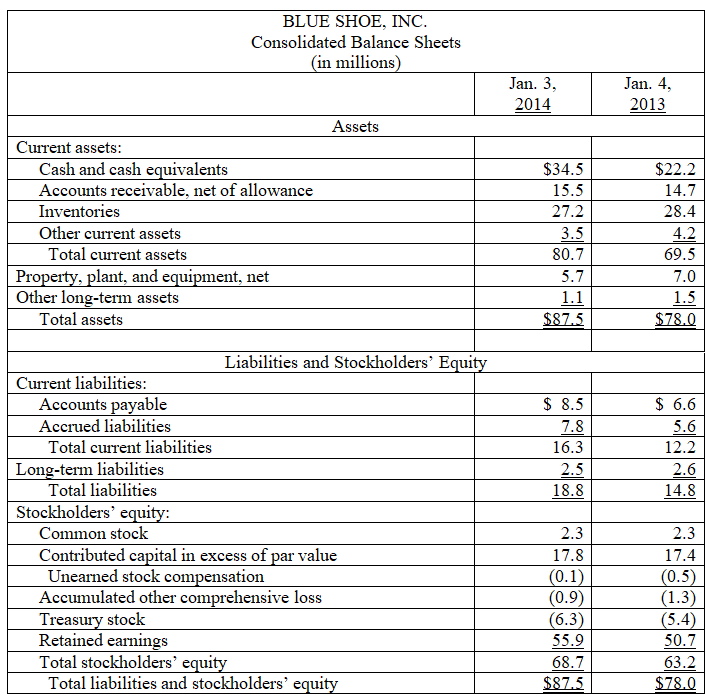

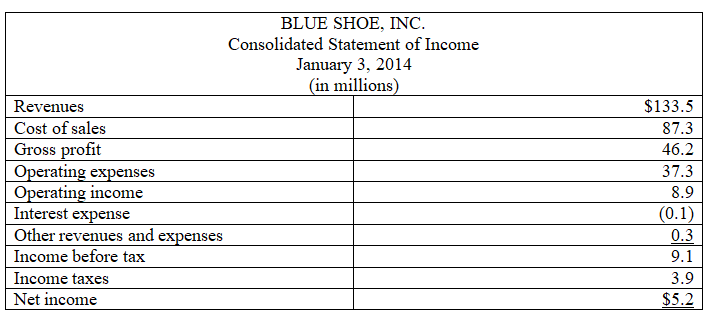

The following are summaries from the income statements and balance sheets of Red Shoe,Inc.and Blue Shoe,Inc.

(1) For both companies compute the following ratios for 2014:

(a) Current ratio

(b) Acid-test ratio

(c) Accounts receivable turnover

(d) Inventory turnover

(e) Days' sales in inventory

(f) Days' sales uncollected

Which company do you consider to be the better short-term credit risk? Explain.

(2) For both companies compute the following ratios for 2014:

(a) Profit margin ratio

(b) Return on total assets

(c) Return on common stockholders' equity

Which company do you consider to have better profitability ratios?

Definitions:

Aldosterone

Steroid hormone produced by the zona glomerulosa of the adrenal cortex that facilitates potassium exchange for sodium in the distal renal tubule, causing sodium reabsorption and potassium and hydrogen secretion.

Na+

Sodium ions, which are essential for various physiological functions, including nerve impulse transmission and muscle contraction.

Nephron

Functional unit of the kidney, consisting of the renal corpuscle, the proximal convoluted tubule, the loop of Henle, and the distal convoluted tubule.

Interstitial Fluid

The fluid that surrounds the cells in tissues, providing nutrients and removing waste.

Q6: A record of the increases and decreases

Q22: What are the standards for financial analysis

Q29: Earnings per share is the amount of

Q70: Explain the preparation of journal entries to

Q72: The appropriate section in the statement of

Q108: A noncash investing transaction should be disclosed

Q131: Required: Calculate the net cash flows provided

Q137: A company has bonds outstanding with a

Q182: Selected balances from a company's financial statements

Q196: A company was organized in January 2012