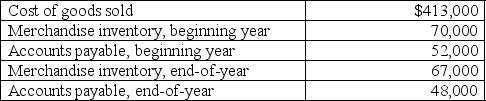

Based on the following information provided about a company's operations,calculate its cost of goods purchased and its cash paid for merchandise.

Definitions:

Unit Variable Costs

Unit variable costs are the costs that vary directly with the production volume, including costs for materials and labor that change with the level of production or service provision.

Operating Income

Revenue obtained from the main operations of a business, not including the costs of interest and taxes.

Variable Costs

Expenditures that fluctuate in direct relation to production or sales volumes, such as labor costs and materials used.

Fixed Costs

are expenses that do not change in total over a period of time, regardless of the level of production or sales volume, such as rent or salaries.

Q42: Wessen Company reports net income of $200,000

Q76: A payroll register is a cumulative record

Q101: Trade accounts payable are amounts owed to

Q110: A company issues bonds with a par

Q110: Net income divided by average total assets

Q114: A corporation borrowed $125,000 cash by signing

Q131: What is Corona Company's days' sales in

Q171: The current ratio is calculated as current

Q201: The least amount that the buyers of

Q208: Changes in accounting estimates are:<br>A)Considered accounting errors.<br>B)Reported