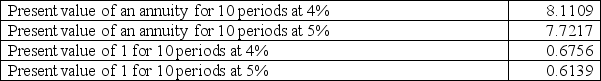

On January 1,a company issues bonds with a par value of $300,000.The bonds mature in five years and pay 8% annual interest,payable each June 30 and December 31.On the issue date,the market rate of interest for the bonds is 10%.Compute the price of the bonds on their issue date.The following information is taken from present value tables:

Definitions:

Dividends

Profit shares dispensed by a business to its stakeholder members, frequently sourced from the corporate earnings.

Cash Flow

The comprehensive tally of funds being shuffled in and out of a corporation, impacting its short-term financial stability.

Creditors

Individuals, businesses, or financial institutions that have lent money or extended credit and are owed repayment of the debt.

Book Value

The net value of a company's assets, minus its liabilities and intangible assets such as goodwill.

Q57: A company purchased mining property containing 7,350,000

Q67: _ leases are short-term or cancelable leases

Q97: Unsecured bonds are also called _ and

Q116: Achieving an increased return on common stock

Q134: The wage and tax statement is:<br>A)Form 940<br>B)Form

Q136: A company purchased equipment on July 3

Q140: A company issued 10-year,9% bonds with a

Q143: Operating leases are long-term or noncancelable leases

Q163: A promissory note is a written promise

Q201: The least amount that the buyers of