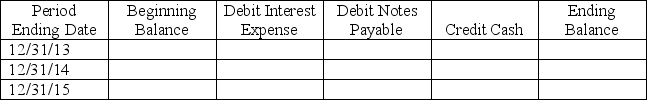

A company purchased two new trucks for a total of $250,000 on January 1,2013.The company paid $40,000 cash and gave a $210,000,three-year,8% note for the remaining balance.The note is to be paid in three annual end-of-year payments beginning December 31,2013.Assume the annual installment payments are to consist of equal amounts of principal plus accrued interest.Prepare a note amortization table using the format below.

Definitions:

Investment Potential

This refers to the likelihood or capacity for an investment to grow in value, offering returns to the investor.

Discounted Present Value

Discounted present value is a financial calculation that determines the current worth of a future sum of money or stream of cash flows, given a specified rate of return.

Financial Attribute

Characteristics or information pertaining to financial entities, transactions, or instruments that can be measured or identified, such as price, yield, risk, or returns.

Dividends

Payments made by a corporation to its shareholder members, usually derived from profits.

Q53: A company sells leaf blowers for $170

Q57: A company has 10%,20-year bonds outstanding with

Q67: The Orlando Magic received $6 million cash

Q72: For the year ended December 31,2013,Mason Company

Q81: A _ is a seller's obligation to

Q92: A company used straight-line depreciation for an

Q92: Northwest Corporation's salaries expense was $18.0 million.What

Q114: A company purchased land on which to

Q126: On January 1,2013,Lane issues $700,000 of 7%,15-year

Q176: Reynaldo Inc.issued 1,000 shares of $10 stated