A company issued 10%,five-year bonds with a par value of $2,000,000,on January 1,2013.Interest is to be paid semiannually each June 30 and December 31.The bonds were sold at $2,162,290 to yield the buyers an 8% annual return.The company uses the effective interest method of amortization.

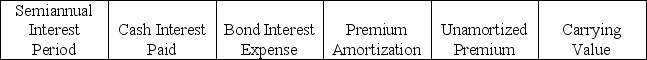

(1) Prepare an amortization table for the first two semiannual payment periods using the format shown below.

(2) Prepare the general journal entry to record the first semiannual interest payment.

(2) Prepare the general journal entry to record the first semiannual interest payment.

Definitions:

Zygote

The earliest developmental stage of an embryo, formed when a sperm cell fertilizes an egg cell, which then begins to divide and grow.

Germinal Period

The initial two weeks of prenatal development following conception, characterized by rapid cell division and the beginning of cell differentiation.

Implantation

The process by which a fertilized egg attaches to the lining of the uterus to begin pregnancy.

Uterine Wall

The muscular layer lining the uterus, which thickens during the menstrual cycle and pregnancy.

Q8: A company purchased equipment for $325,000 on

Q10: _ depreciation recognizes equal amounts of annual

Q35: How is the cost principle applied to

Q93: Plant assets are:<br>A)Tangible assets used in the

Q110: A company issues bonds with a par

Q130: Strait Corp.sold 10,000 shares of $1 par

Q135: Marble Corporation had the following balances in

Q185: _ bonds can be exchanged for a

Q194: Most companies use accelerated depreciation for tax

Q198: On January 10,a corporation purchased 5,000 shares