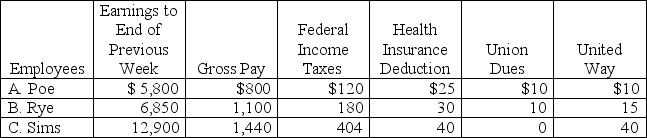

The payroll records of a company provided the following data for the currently weekly pay period ended March 7:

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $110,100 (for 2012) and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $110,100 (for 2012) and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.

Calculate the net pay for each employee.

Definitions:

Military

The armed forces of a country, responsible for defending it from external threats and ensuring internal security, often involving significant personnel and technology.

Capital Stock

The total value of all durable goods available for use in production, including machinery, buildings, and equipment.

Increase

A situation where there is a rise in quantity, size, number, value, or intensity of a particular economic variable or element.

Sub-Prime Loan

A type of loan that is offered at a rate above prime to individuals who do not qualify for prime rate loans, usually because of poor credit histories.

Q3: On January 1,2013,a company borrowed $50,000 cash

Q11: The formula for calculating total asset turnover

Q22: In year 1,a company had net sales

Q23: An installment note is an obligation to

Q36: Myrex Corporation purchased $4,000 in merchandise from

Q95: Identify and discuss the factors involved in

Q97: Holders of _ have a right to

Q128: On January 1,2013,Leyden Corporation leased a truck,agreeing

Q194: Identify and describe the two main components

Q206: Revenue expenditures:<br>A)Are additional costs of plant assets