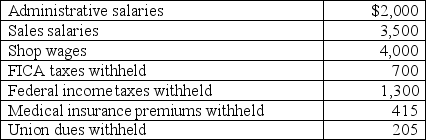

A company's payroll information for the month of May follows:

On May 31 the company issued Check No.335 payable to the Payroll Bank Account for the May payroll.It issued payroll checks to the employees after depositing the check.

On May 31 the company issued Check No.335 payable to the Payroll Bank Account for the May payroll.It issued payroll checks to the employees after depositing the check.

(1) Prepare the journal entry to record (accrue) the employer's payroll for May.(2) Prepare the journal entry to pay for the May payroll.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.The wages and salaries subject to these taxes were $6,000.(3) Prepare the journal entry to record the employer's payroll taxes.

Definitions:

SOM

Share of market; the portion of SAM that your company is realistically likely to reach.

TAM

Total available market; the total market demand for a product or service.

Total Available Market

The overall revenue opportunity available or total demand for a product or service within a market.

Entrepreneur-Intended

Describes a person or action deliberately aimed at creating new ventures or businesses, typically with a plan and intention to grow.

Q16: The three main factors in computing depreciation

Q18: Assume that at the end of the

Q52: Treating capital expenditures of a small dollar

Q54: Cash equivalents:<br>A)Are short-term,highly liquid investments.<br>B)Include six-month CDs.<br>C)Include

Q70: On January 1,2013,Lane issues $700,000 of 7%,15-year

Q100: Mahoney Company had the following transactions involving

Q104: Describe the accounting for intangible assets,including their

Q135: A _ shows the pay period dates,hours

Q180: A single liability can be divided between

Q188: Explain the difference between revenue expenditures and