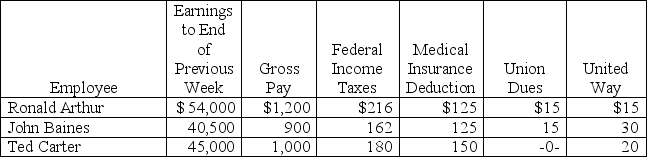

The payroll records of a company provided the following data for the weekly pay period ended December 7:

The FICA Social Security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Prepare the journal entries to (a) accrue the payroll and (b) record payroll taxes expense.

The FICA Social Security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Prepare the journal entries to (a) accrue the payroll and (b) record payroll taxes expense.

Definitions:

Pension Expense

The annual cost recognized by an employer for its contributions to employees' retirement plans, reflecting the cost of benefits earned by employees during the year.

Pension Funding

The process of allocating financial resources to a pension plan to meet future obligations to retirees.

Upcoming Year

Refers to the next calendar or fiscal year that is approaching and for which plans, budgets, or forecasts are being prepared.

Marginal Income Tax Rates

The percentage of tax applied to your income for each tax bracket in which you qualify.

Q4: The purchase of a property that included

Q24: A company's outstanding stock consists of (a)

Q25: Gamer Inc.determines that it cannot collect $60

Q65: Depreciation:<br>A)Measures the decline in market value of

Q105: A discount on bonds payable occurs when

Q126: Separation of duties divides responsibility for a

Q152: A company purchased a machine for $75,000

Q157: A company purchased mining property that containing

Q163: Bonds that give the issuer an option

Q191: On April 1,2013,a company disposed of equipment