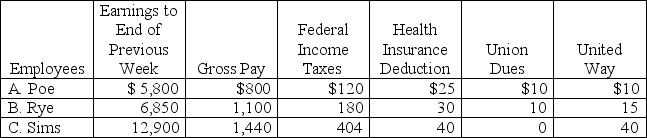

The payroll records of a company provided the following data for the currently weekly pay period ended March 7:

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $110,100 (for 2012) and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $110,100 (for 2012) and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.

Calculate the net pay for each employee.

Definitions:

Reflexive Smile

An involuntary smile, often seen in babies, which does not necessarily occur in response to external stimuli.

Effortful Control

The ability to regulate one's behavior through conscious control as opposed to automatic or instinctive reactions.

Exuberance

Lively energy and excitement, often showing in behavior or enthusiasm.

Separate Persons

The concept or state of being distinct or individual entities, not connected or amalgamated with others.

Q10: Crystal Products allows customers to use bank

Q28: Bonds that have an option exercisable by

Q30: The Federal Insurance Contributions Act (FICA) requires

Q45: Another name for a capital expenditure is:<br>A)Revenue

Q68: _ bonds have an option exercisable by

Q114: The difference between the amount received from

Q129: A bank that is authorized to accept

Q145: When there is little uncertainty surrounding current

Q152: _ are responsible for and have final

Q166: An _ is an obligation requiring a