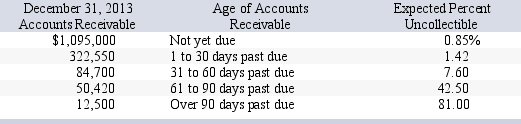

Chiller Company has credit sales of $5.60 million for year 2013.Chiller estimates that 1.32% of the credit sales will not be collected.Historically,4% of outstanding accounts receivable is uncollectible.On December 31,2013,the company's Allowance for Doubtful Accounts has an unadjusted credit balance of $3,561.Chiller prepares a schedule of its December 31,2013,accounts receivable by age.Based on past experience,it estimates the percent of receivables in each age category that will become uncollectible.This information is summarized here:  Assuming the company uses the percent of sales method,

Assuming the company uses the percent of sales method,

-What is the amount that Chiller will enter as the Bad Debt Expense in the December 31 adjusting journal entry?

Definitions:

Market

A venue where goods, services, or financial instruments are exchanged between buyers and sellers, either physically or electronically.

Beta

An indicator of a stock's fluctuation compared to the general market, where a beta above 1 signals increased volatility.

Risk-Free Rate

An estimated profit from a risk-free investment, commonly illustrated by government security yields.

Expected Return

The anticipated percentage gain or loss that an investor predicts a stock or investment will earn in the future based on historical or calculated projections.

Q17: On August 1,2013,Ace Corporation accepted a note

Q23: A company had 270 units of inventory

Q58: A supplementary record created to maintain a

Q82: A company that uses a perpetual inventory

Q95: Acme-Jones Corporation uses a weighted average perpetual

Q101: The three usual means for disposal of

Q118: What is the amount that should be

Q165: Assume that this company's bad debts are

Q167: Obsolescence:<br>A)Occurs when an asset is at the

Q202: Given the following information,determine the cost of