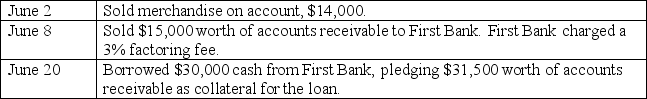

On May 31,a company had a balance in its accounts receivable of $103,895.Record the company's following transactions for June:

Definitions:

Average Tax Rate

The proportion of total income that is paid in taxes, calculated by dividing the total taxes paid by the total taxable income.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, indicating the percentage of additional income that will be taxed.

Marginal Tax Rate

The rate at which the next dollar of taxable income will be taxed.

Total Income

The sum of all earnings received by an individual or entity, including wages, salaries, benefits, and income from investments.

Q3: As long as a company accurately records

Q57: A company had 240 units of inventory

Q67: Some companies use the _ constraint or

Q83: The _ method of assigning costs to

Q84: Total asset cost plus depreciation expense equals

Q85: An overstated beginning inventory will _ cost

Q106: Home Depot had income before interest expense

Q148: Writing off an uncollectible account receivable when

Q174: Given the following information: <br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6947/.jpg" alt="Given

Q184: The document,also known as the check authorization,that