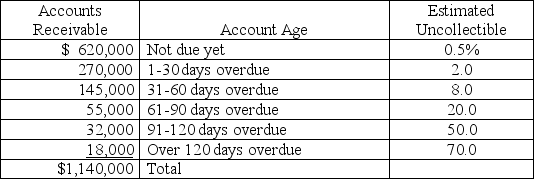

A company uses the aging of accounts receivable method to estimate its bad debts expense.On December 31 of the current year,an aging analysis of accounts receivable revealed the following:

Required:

Required:

a.Calculate the amount of the allowance for doubtful accounts that should be reported on the current year-end balance sheet.

b.Calculate the amount of the bad debts expense that should be reported on the current year's income statement,assuming that the balance of the allowance for doubtful accounts on January 1 of the current year was $44,000 and that accounts receivable written off during the current year totaled $49,200.

c.Prepare the adjusting journal entry to record bad debts expense on December 31 of the current year.

d.Show how accounts receivable will appear on the current year-end balance sheet as of December 31.

Definitions:

Counterparty

The other organization or party involved in a financial transaction.

Interest Rate Differential

The difference in interest rates between two distinct economic or financial entities, typically affecting currency value or investment decisions.

Forward Exchange Rates

Exchange rates at which two parties agree to exchange currencies at a future date.

Interest Rate Parity

A theory which states that the difference in interest rates between two countries is equal to the difference between the forward exchange rate and the spot exchange rate.

Q13: Interim statements:<br>A)Are required by Congress.<br>B)Are necessary to

Q14: The following information is available to reconcile

Q50: Discuss the important accounting features of a

Q82: A bank reconciliation explains any differences between

Q83: A depreciable asset currently has a $24,500

Q114: The difference between the amount received from

Q114: Brown Company's bank statement for September 30

Q150: After preparing a bank reconciliation,a company must

Q166: A company had the following ending inventory

Q202: Given the following information,determine the cost of