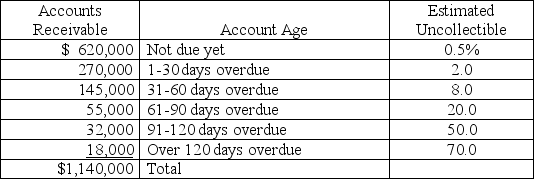

A company uses the aging of accounts receivable method to estimate its bad debts expense.On December 31 of the current year,an aging analysis of accounts receivable revealed the following:

Required:

Required:

a.Calculate the amount of the allowance for doubtful accounts that should be reported on the current year-end balance sheet.

b.Calculate the amount of the bad debts expense that should be reported on the current year's income statement,assuming that the balance of the allowance for doubtful accounts on January 1 of the current year was $44,000 and that accounts receivable written off during the current year totaled $49,200.

c.Prepare the adjusting journal entry to record bad debts expense on December 31 of the current year.

d.Show how accounts receivable will appear on the current year-end balance sheet as of December 31.

Definitions:

Basic Considerations

Fundamental factors or elements that must be taken into account when making decisions or evaluations.

Evaluation Interviews

Structured conversations between an employee and supervisor aimed at assessing performance, providing feedback, and discussing career development.

Guidelines for Effectiveness

Principles or strategies aimed at enhancing the efficiency and success of a process or organization.

Globalization

The trend to opening up foreign markets to international trade and investment.

Q8: The accounts receivable turnover is calculated by

Q31: A company received a $1,000,90-day,10% note receivable.The

Q40: Sales taxes payable:<br>A)Is an estimated liability.<br>B)Is a

Q91: The full disclosure principle:<br>A)Requires that when a

Q91: A common rule of thumb is that

Q92: A company has inventory with a market

Q119: _ are capital expenditures that make a

Q166: The accountant for Wade Inc.prepared the bank

Q194: The conservatism constraint:<br>A)Requires that when more than

Q196: A copyright gives its owner the exclusive