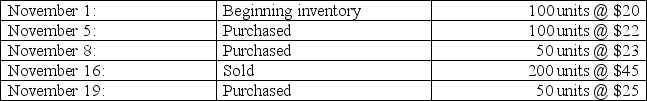

A company uses the periodic inventory system and had the following activity during the current monthly period: Using the weighted average inventory method,the company's ending inventory would be reported at:

Using the weighted average inventory method,the company's ending inventory would be reported at:

Definitions:

Gross Payroll

The total amount an employer pays to its employees before deductions, such as taxes and retirement contributions, are made.

Federal Unemployment Compensation Tax

A federal tax imposed on employers to fund state workforce agencies and unemployment insurance.

Employer's Payroll Taxes

Taxes that employers are required to pay on behalf of their employees, such as social security and Medicare taxes in the United States.

Federal Income Tax

The tax levied by the IRS on the annual earnings of individuals, corporations, trusts, and other legal entities.

Q28: Ben and Jerry's had total assets of

Q28: A company has the following unadjusted account

Q33: J.C.Penney had net sales of $24,750 million,cost

Q53: An overstatement of ending inventory will cause<br>A)An

Q136: Explain the options a company has when

Q145: Collusion is when a person embezzles money

Q153: Good internal control dictates that a person

Q163: A promissory note is a written promise

Q173: The use of an allowance for bad

Q180: Physical inventory counts:<br>A)Are not necessary under the