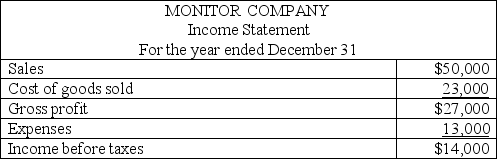

Monitor Company uses the LIFO method for valuing its ending inventory.The following financial statement information is available for their first year of operation:

Monitor's ending inventory using the LIFO method was $8,200.Monitor's accountant determined that had they used FIFO,the ending inventory would have been $8,500.

Monitor's ending inventory using the LIFO method was $8,200.Monitor's accountant determined that had they used FIFO,the ending inventory would have been $8,500.

a.Determine what the income before taxes would have been had Monitor used the FIFO method of inventory valuation instead of LIFO

b.What would be the difference in income taxes between LIFO and FIFO,assuming a 30% tax rate?

Definitions:

Input Demand

The requirement for resources and materials necessary to produce goods and services.

Output Demand

The quantity of a product or service that consumers are willing and able to purchase at various price points.

Immigration Effect

The impact that immigration has on a host country's economy, labor market, culture, and social fabric, both positive and negative.

Market Labor

The supply of available workers in relation to employment opportunities within a given market or industry.

Q28: Bert and John Jacobs founded a T-shirt

Q40: Spears Company uses the periodic inventory method.On

Q46: Describe the key attributes of inventory for

Q101: Given the following information: <br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6947/.jpg" alt="Given

Q102: Given the following events,what is the per-unit

Q127: The matching principle and the full disclosure

Q174: A company had net sales of $82,000,cost

Q175: Following are selected accounts and their balances

Q192: The internal document that is used to

Q213: Total Company has current liabilities in the