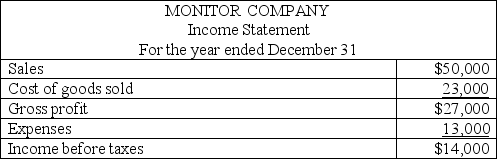

Monitor Company uses the LIFO method for valuing its ending inventory.The following financial statement information is available for their first year of operation:

Monitor's ending inventory using the LIFO method was $8,200.Monitor's accountant determined that had they used FIFO,the ending inventory would have been $8,500.

Monitor's ending inventory using the LIFO method was $8,200.Monitor's accountant determined that had they used FIFO,the ending inventory would have been $8,500.

a.Determine what the income before taxes would have been had Monitor used the FIFO method of inventory valuation instead of LIFO

b.What would be the difference in income taxes between LIFO and FIFO,assuming a 30% tax rate?

Definitions:

Plot

The sequence of events or main storyline in a narrative, including the conflict, climax, and resolution.

Bone Density

The measurement of the amount of mineral matter per square centimeter of bones, used as an indicator of strength and risk for osteoporosis.

Deep Sleep Disorders

A category of sleep disorders that affect the ability to achieve or maintain deep, restorative sleep stages.

Sleep Terrors

Frightening, dream-like experiences that occur during the deepest stage of NREM sleep; nightmares, in contrast, occur during REM sleep.

Q3: During a period of steadily rising costs,the

Q43: For a corporation,the equity section is divided

Q66: Identify whether each of the following items

Q77: Wallah Company agreed to accept $5,000 in

Q80: On May 1,2014,Giltus Advertising Company received $1,500

Q93: Given the following information,determine the cost of

Q119: The following items appeared on a company's

Q161: A company reported the following data:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6947/.jpg"

Q166: After adjustment,the allowance for doubtful accounts has

Q190: A company had revenue of $550,000,rent expense