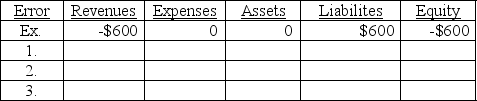

Given the table below, indicate the impact of the following errors made during the adjusting entry process. Use a "+" followed by the amount for overstatements, a "-" followed by the amount for understatements and a "0" for no effect. The first one is done as an example.

Ex. Failed to recognize that $600 of unearned revenues, which were previously recorded as liabilities, had been earned by year-end.

1. Failed to accrue salaries expense of $1,200.

2. Forgot to record $2,700 of depreciation on office equipment.

3. Failed to accrue $300 of interest on a note receivable.

Definitions:

Direct Labor Hours

The total hours worked directly on producing a product or delivering a service, often used as a basis for allocating manufacturing overhead to products or services.

Engineering Changes

Modifications to the design, materials, or specifications of a product or system, often made to improve performance, reduce costs, or correct defects.

Indirect Cost

Expenses not directly tied to the production of goods or services, such as administrative salaries, rent, and utilities.

Days' Payable Outstanding

A financial metric that calculates the average time it takes a company to pay its invoices from suppliers, reflecting its payment process efficiency.

Q75: Indicate whether a debit or credit entry

Q95: A company had total assets of $350,000;

Q121: Which financial statements are prepared for a

Q131: If a company sells merchandise with credit

Q151: Which of the following is the appropriate

Q167: Reebok's net income of $119 million and

Q170: Teasdale Printing Services purchases printing equipment on

Q201: During January,a company that uses a perpetual

Q227: Classified balance sheets commonly include the following

Q239: Which of the following accounts would be