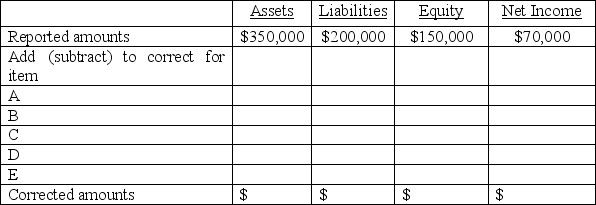

A company issued financial statements for the year ended December 31 but failed to include the following adjusting entries:

A.Accrued service fees earned of $2,200.

B.Depreciation expense of $8,000.

C.Portion of office supplies (an asset) used,$3,100.

D.Accrued salaries of $5,200.

E.Revenues of $7,200,originally recorded as unearned,have been earned by the end of the year.

Determine the correct amounts for the December 31 financial statements by completing the following table:

Definitions:

Investments

Assets purchased with the expectation that they will generate income in the future or appreciate in value for future resale.

Operating Cash Flow

The revenue generated by a company through its primary business functions.

Interest Expense

This is the cost incurred by an entity for borrowed funds, which can include the cost of bonds, loans, and lines of credit.

Depreciation

The allocation of the cost of an asset over its useful life, reflecting the loss in value over time.

Q10: Unearned revenues are classified as liabilities.

Q26: An asset created by prepayment of an

Q40: Grotto Company pays a vendor $900 cash

Q65: Identify the two main groups involved in

Q94: The _ is a record containing all

Q101: Return on assets is:<br>A)Also called rate of

Q121: A wholesaler is an intermediary that buys

Q130: When purchase costs regularly rise,the _ method

Q143: All necessary numbers to prepare the income

Q187: The year-end adjusted trial balance of ABC