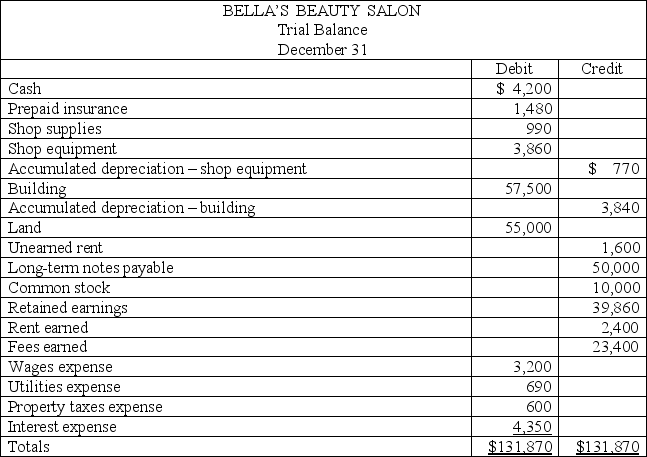

Use the following information to prepare the adjusted trial balance for Bella's Beauty Salon.Bella's Beauty Salon's unadjusted trial balance for the current year follows:

Additional information:

Additional information:

a.An insurance policy examination showed $1,240 of expired insurance.

b.An inventory count showed $210 of unused shop supplies still available.

c.Depreciation expense on shop equipment,$350.

d.Depreciation expense on the building,$2,220.

e.A beautician is behind on space rental payments and $200 of accrued revenue was unrecorded at the time the trial balance was prepared.

f.$800 of the Unearned Rent account balance was earned by year-end.

g.The one employee,a receptionist,works a five-day workweek at $50 per day.The employee was paid last week but has worked four days this week for which she has not been paid.

h.Three months' property taxes,totaling $450,have accrued.This additional amount of property taxes expense has not been recorded.

i.One month's interest on the note payable,$600,has accrued but is unrecorded.

Definitions:

Unilateral Contract

A binding agreement in which one party promises to do something in return for an act of the other party, rather than a promise.

Profit Participation

A financial arrangement where an individual's or entity's income is partially derived from the profits of a business or project.

Feature Documentary

A non-fiction film that focuses on real-life events or issues, offering in-depth exploration.

5-Metre Maples

A term possibly referring to maple trees that have reached a height of five meters, although '5-Metre Maples' does not appear to be a standard term in a specific field.

Q26: An asset created by prepayment of an

Q80: Explain the effects of inventory valuation methods

Q96: _ identify and describe transactions and events

Q105: _ expenses are those costs that are

Q120: Calculate net income.

Q129: A debit is:<br>A)An increase in an account.<br>B)The

Q134: When a company has no reportable nonoperating

Q152: The accrual basis of accounting is an

Q192: For each of the following errors,indicate on

Q215: The credit purchase of a delivery truck