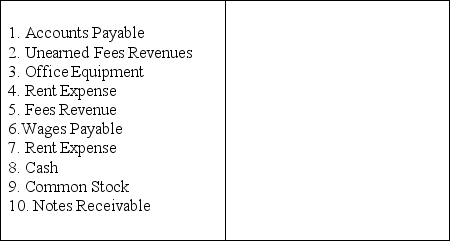

The following accounts appear on either the income statement (IS) or balance sheet (BS).In the space provided next to each account write the letters IS or BS that identify the statement on which the account appears.

Definitions:

Federal Income Tax

An annual financial obligation collected by the IRS from individuals, corporations, trusts, and other legal organizations.

Gross Earnings

The total income earned by an individual or a business before any deductions or taxes are taken out.

Withholding Allowance

A claim made by an employee on a form W-4 to determine the amount of income tax withheld from their paycheck.

Federal Income Tax

A charge imposed by the IRS on the yearly income of persons, corporations, trusts, and various legal bodies.

Q17: On December 14 Bench Company received $3,700

Q18: Accurate source documents are crucial to accounting

Q19: _ refers to the programs that help

Q66: The _ ratio is a measure of

Q100: Maria Sanchez began business as Sanchez Law

Q116: Revenues and expenses are two categories of

Q134: The debt ratio reflects the risk of

Q146: U.S.government bonds are:<br>A)High-risk and high-return investments.<br>B)Low-risk and

Q160: Prepare a December 31 balance sheet in

Q163: Accounting is one way important financial information