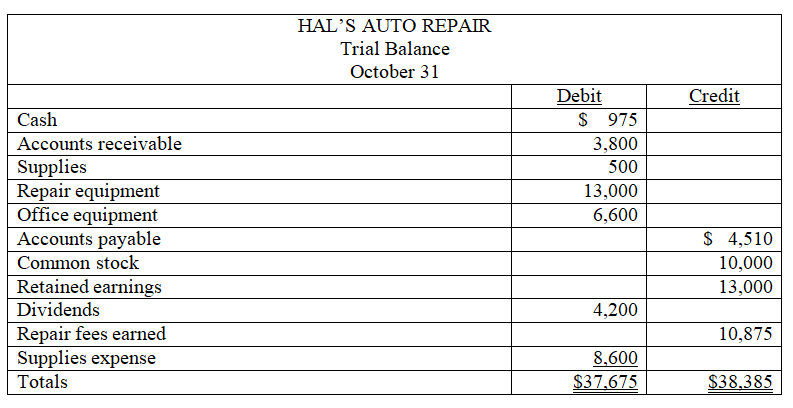

The following trial balance was prepared from the general ledger of Hal's Auto Repair.

Since the trial balance did not balance, you decided to examine the accounting records. You found that the following errors had been made:

1.A purchase of supplies on account for $245 was posted as a debit to Supplies and as a debit

to Accounts Payable.

2.An investment of $500 cash by the owner was debited to Common Stock and credited to

Cash.

3.In computing the balance of the Accounts Receivable account,a debit of $600 was omitted

from the computation.

4.One debit of $300 to the Dividends account was posted as a credit.

5.Office equipment purchased for $800 was posted to the Repair Equipment account.

6.One entire entry was not posted to the general ledger.The transaction involved the receipt

of $125 cash at the time repair services were performed.

Prepare a corrected trial balance for the Hal's Auto Repair as of October 31.

Definitions:

Hybridization

The concept of mixing atomic orbitals to create new hybrid orbitals for bonding, explaining the geometry of molecular structures.

Nitrogen Atom

An atom of the element nitrogen, which has the chemical symbol N and is essential for all living organisms as it is a key component of amino acids and nucleic acids.

CCC Bond Angle

The angle between three carbon atoms in a molecular structure, which can vary depending on the specific geometry of the molecule.

Compound

A chemical substance made up of two or more elements combined in a specific ratio, distinct in its chemical composition and properties.

Q15: If the partners agree on a formula

Q90: Calculate ending retained earnings.

Q117: Discuss how technology-based information systems affect accounting.

Q125: When posting from special journals,each debit and

Q195: If a company forgot to record depreciation

Q199: A post-closing trial balance is a list

Q208: The accrual basis of accounting:<br>A)Is generally accepted

Q217: A company acquires equipment for $75,000 cash.This

Q222: A simple account form widely used in

Q227: Another name for equity is:<br>A)Net income<br>B)Expenses<br>C)Net assets<br>D)Revenue<br>E)Net