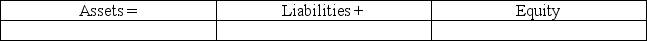

On May 1,Chuck Taylor formed FastForward,a shoe consulting business as a corporation.To start the business he invested $750,000 in cash.Enter the appropriate amounts for this transaction into the accounting equation format shown below:

Definitions:

Marginal Tax Rate

The rate of tax applied to the last dollar of income, representing the percentage of tax paid on additional income.

Salvage Value

The projected value at which an asset can be sold upon reaching the end of its operational lifespan.

Tax Liability

The total amount of tax owed by an individual, corporation, or other entity to a taxing authority, such as the IRS.

Salvage Value

The anticipated market price of an asset upon the conclusion of its effective service life.

Q38: If a prepaid expense account were not

Q80: When a company provides services for which

Q115: Which of the following best lists the

Q116: Long-term investments in available-for-sale securities are reported

Q122: In the absence of a partnership agreement,the

Q124: Consolidated statements are prepared as if a

Q156: Detalo Co.held bonds of Schooner Corp.with a

Q159: On September 1,2014,Rode Corp.paid $100,000 plus a

Q168: Which of the following statements is true?<br>A)Assets

Q212: From the adjusted trial balance,prepare an income