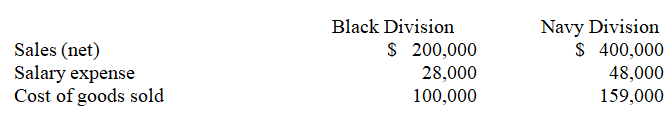

Marian Corporation has two separate divisions that operate as profit centers.The following information is available for the most recent year:  The Black Division occupies 20,000 square feet in the plant.The Navy Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.

The Black Division occupies 20,000 square feet in the plant.The Navy Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.

-Compute departmental income for the Black and Navy Divisions,respectively.

Definitions:

Revaluation Approach

A method of accounting that involves periodic updating of the carrying value of an asset or liability to its current market value.

Net Assets

The total assets of a company minus its total liabilities, representing the owners' equity.

Indirect Ownership Interests

Refers to ownership in an entity through intermediary entities rather than direct control or ownership of the underlying assets.

Direct Ownership Interests

Ownership interest in an asset or entity without intermediaries, implying direct control or influence over the asset or entity.

Q13: Standard costs are used in the calculation

Q17: Capital budgeting decisions are risky because the

Q19: When the amount invested differs substantially across

Q20: Identify the five steps involved in managerial

Q78: Franklin Co.has three departments: purchasing,human resources,and assembly.In

Q87: Pinkin Inc.needs to determine a price

Q93: Jefferson Co.uses the following standard to produce

Q119: The calculation of the payback period for

Q167: A company's flexible budget for 30,000 units

Q204: Clevenger Co.planned to produce and sell 30,000