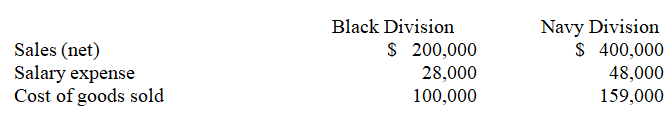

Marian Corporation has two separate divisions that operate as profit centers.The following information is available for the most recent year:  The Black Division occupies 20,000 square feet in the plant.The Navy Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.

The Black Division occupies 20,000 square feet in the plant.The Navy Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.

-Compute gross profit for the Black and Navy Divisions,respectively.

Definitions:

Customer Benefit Plan

A strategy or program developed by businesses to offer added value or benefits to customers, aiming to increase customer satisfaction and loyalty.

Creating Steps

Developing phases or actions in a plan or process to achieve a specific goal.

SMART

An acronym standing for Specific, Measurable, Achievable, Relevant, and Time-bound, commonly used to guide goal setting.

Mental Step

A cognitive phase in problem-solving where an individual contemplates various solutions or decisions.

Q13: Gion Company is considering eliminating its windows

Q18: A company is considering the purchase of

Q38: Production budgets always show both budgeted units

Q50: Sales mix refers to the combination of

Q78: A managerial accounting report that presents predicted

Q102: Standard costs can be used by management

Q118: Hassock Corp.produces woven wall hangings.It takes 2

Q124: Zhang Industries sells a product for $700.Unit

Q133: Ultimo Co.operates three production departments as profit

Q202: Ultimo Co.operates three production departments as profit